Auto sector booms in November across sectors, Ashok Leyland sold 29% more, M&M grew by 19%

Dec 01, 2025

New Delhi [India], December 1 : Vehicle sales across categories performed exceedingly well in November, continuing robust performance since the reduced GST rates on vehicles came into effect this Navratri.

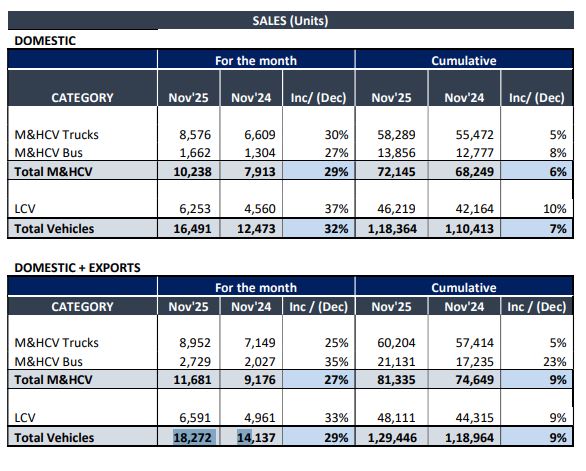

Ashok Leyland registered a 29 per cent jump in sales in November, domestic and exports combined, at 18,272 units. Trucks, buses, Light Commercial Vehicle all logged strong sales growth, the company's data released on Monday showed.

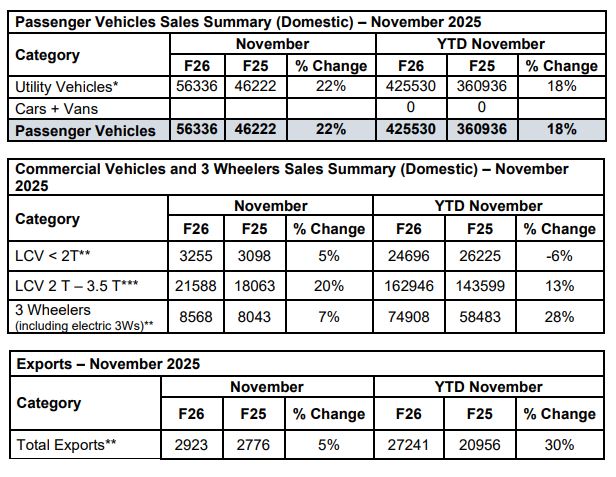

Mahindra & Mahindra's overall auto sales for the month of November 2025 stood at 92,670 vehicles, a growth of 19 per cent, including exports.

In the Utility Vehicles segment, Mahindra sold 56,336 vehicles in the domestic market, a growth of 22 per cent and overall, 57,598 vehicles, including exports. The domestic sales for

Commercial Vehicles stood at 24,843, a growth of 17 per cent, the company sales figures showed today.

Nalinikanth Gollagunta, CEO, Automotive Division, M&M Ltd., said, "In November, we achieved SUV sales of 56,336 units, a growth of 22 per cent. The total vehicle sales stand at 92,670 units, a 19 per cent year-on-year growth. We also celebrated the one-year anniversary of our Electric Origin SUVs and launched India's first authentic Electric Origin 7-seater SUV - the XEV 9S - along with the world's first Formula E-themed special edition SUV, the Mahindra BE 6 Formula E Edition."

Escorts Kubota Limited, a tractor maker, sold 10,580 tractors in November, registering a growth of 17.9 per cent as against 8,974 tractors sold in November 2024, the company data showed.

Domestic tractor sales in November 2025 were at 10,122 tractors registering a growth of 15.9 per cent as against 8,730 tractors in November 2024.

Export tractor sales in November 2025 were at 458 tractors registering a growth of 87.7 per cent as against 244 tractors sold in November 2024.

It said that the tractor industry continued its upward trajectory in November, supported by government initiatives, reduced GST rates and subsidies on agricultural machinery, which have made tractors more affordable for farmers.

"Retail sales experienced a notable increase as the Kharif harvesting season came to a close and Rabi sowing advanced smoothly. Improved reservoir levels from last year have guaranteed ample water supply, setting a promising outlook for the upcoming season. Moving forward, we anticipate sustained growth for the remainder of the fiscal year," Escorts Kubota said in the statement, while releasing the sales figures for November.

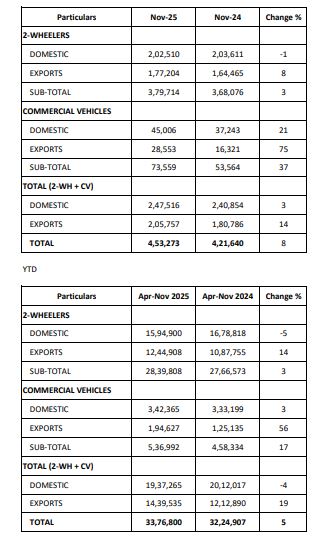

Coming to Bajaj Auto Limited, it reported sales growth in both two wheelers and commercial vehicles, at 3 per cent and 37 per cent, respectively, data showed.

The new GST rates and slabs are having a wide-scale positive impact on the many items related to heavy industries, be it auto, transport, or auto ancillaries.

For instance, the rate cuts for the automobile sector are across different categories. It includes bikes (up to 350cc, which also accommodates bikes of 350cc), Buses, Small cars, Medium and luxury cars, Tractors (<1800cc), among others.

The rates are also being reduced on auto parts.

For small cars, the GST rate has been reduced to 18% from 28%. The small car encompasses petrol engine cars of <1200 cc and not exceeding 4 metres in length, and diesel cars of <1500 cc and not exceeding 4 metres in length.

For large cars, however, GST is tagged at a flat 40% with no cess.

For the agricultural sector, tractors, which were previously taxed at 12 per cent GST, are now taxed at 5 per cent. Tractor tyres and parts, which were in the 18 per cent slab, have also been brought down to 5 per cent.

For buses with a seating capacity of 10+ persons, GST has been reduced from 28% to 18%.

The majority of the components used for the manufacture of motorcars and motorbikes have also been reduced.

In a historic move to simplify the Goods and Services Tax(GST), GST Council in its 56th meeting in early September has reduced the GST structure from four slabs (5%, 12%, 18%, 28%) to two main rates--5% (merit rate) and 18% (standard rate) along with a 40% special rate for sin/luxury goods. These changes came into effect on September 22, 2025.