Benefits of specialised loans for doctors starting a practice

Dec 20, 2025

VMPL

New Delhi [India], December 20: Set up your dream clinic with Bajaj Finserv Doctor Loan designed for medical professionals--covering infrastructure, equipment, and operations with quick approvals and flexible terms.

Launching your own medical practice marks an exciting milestone- a chance to create a space that reflects your values and the kind of care you want to deliver. From finding the right clinic location to setting up infrastructure and assembling your team, every decision shapes the foundation of your success.

While the initial medical setup requires planning and smart financial choices, the right financing makes the journey smooth and rewarding. Specialised doctor loans provide that tailored support - quick access, doctor-centric terms, and seamless processes- so you can establish your clinic confidently from day one. Compared to a generic Loan for Professionals, these solutions are designed specifically around the realities of medical practice.

How doctor loans help you start up and scale

The doctor loans from companies like Bajaj Finance match your professional journey with flexibility and speed- transitioning seamlessly from vision to thriving clinic. Unlike rigid general loans with slow approvals and mismatched terms, the Bajaj Finserv Doctor loan handle irregular early earnings from building your patient base, keeping setup efficient and stress-free.

For instance, a young dentist can use the doctor loan to fund a custom chair and digital X-ray system- an important set-up, to start consultations confidently within weeks. In such instances, Bajaj Finserv Doctor Loan serves as your reliable partner, tailored for ambitious medical professionals.

Advantages of Bajaj Finserv Doctor Loan

Bajaj Finserv Doctor Loan aligns with your real-world needs, respecting your packed schedule, demanding workload, and fluctuating early cash flow. Their streamlined digital applications, rapid approvals, and full transparency let you prioritise patients over paperwork.

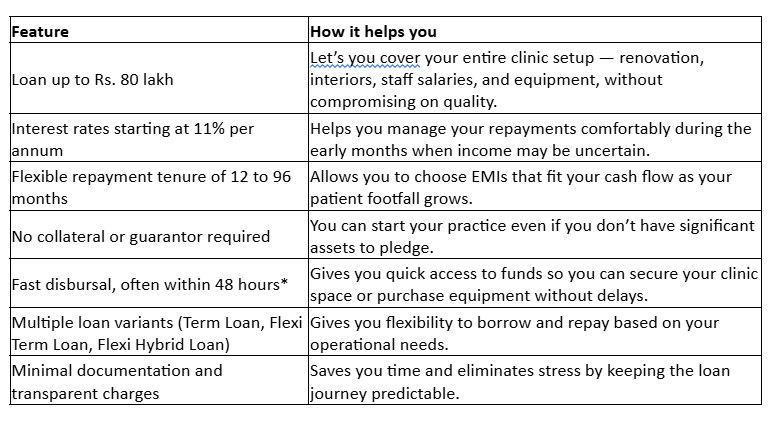

Key features:

When you combine high sanction amounts with flexible repayment and fast processing, the loan becomes a practical tool that supports you from the very beginning of your practice.

How it eases your setup journey

Picture returning after years of training, ready to craft a modern clinic that inspires trust: sleek interiors, advanced diagnostics, skilled team. Prime locations, modern machines, digital records, and operational costs add up fast, but Bajaj Finserv Doctor Loan up to Rs. 80 lakh equips you to function without compromising.

The Flexi Hybrid Term Loan suits startups perfectly: tenure splits into interest-only EMIs initially for easy early repayments, then you can pay principal and interest as cash flow stabilises. You get to withdraw any amount from your sanctioned limit as needed, pay interest only on utilised amounts, and part-prepay anytime with no extra charges, making it ideal for unpredictable growth.

Starting your medical practice is an exciting leap forward, and Bajaj Finserv Doctor Loan provides the strong foundation you need.

T&C apply*

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)