Credit to MSMEs logs steady growth; risk profile improved: CRIF High Mark report

Dec 08, 2025

Mumbai (Maharashtra) [India], December 8 : India companies involved in providing credit to Micro, Small and Medium Enterprises have recorded a steady credit growth and improved risk profile, according to a CRIF High Mark report.

CRIF High Mark, one of India's leading credit bureaus and part of the global CRIF network, has released its latest edition of its MSMEx Spotlight Report, providing a detailed view of India's Micro, Small and Medium Exposure (MSMEx) credit landscape. The report highlights a lending environment shaped by steady portfolio expansion, clearer borrower formalisation, disciplined lender behaviour, and a stable-to-improving risk profile across segments.

India's MSMEx credit exposure (up to Rs 100 crore) stood at Rs 43.3 lakh crore as of September 2025, marking 17.8 per cent year-on-year growth and remaining stable quarter-on-quarter (June 2025: Rs 43.4 lakh crore).

Portfolio growth continues to outpace borrower expansion, signalling a shift toward larger ticket-size lending and maturing customer profiles.

Small businesses have emerged as the largest contributors to exposure, rising from 38.4 per cent to 39.5 per cent year-on-year, with a similar upward shift seen in medium enterprises, with similar declines in the micro segment.

The small segment continues to lead growth, with its share of overall exposure rising from 38.4 per cent to 39.5 per cent over the year and improving quarter-on-quarter.

The medium segment followed a similar trend, increasing its share from 22.5 per cent to 23.1 per cent, and posting steady sequential growth. Micro enterprises still account for most active loans at 86.4 per cent, though their overall exposure remained stable this quarter, reflecting muted movement in micro portfolios.

PSU banks remain the main lenders to micro enterprises with a 36.3 per cent share, according to the CRIF High Mark report.

Private Banks continue to lead the small and medium exposure categories with 46.4 per cent and 47 per cent share respectively.

NBFCs are widening their presence across all borrower groups, increasing their share to 20.1 per cent in micro businesses, 13.9 per cent in small businesses and 15.7 per cent in medium businesses, with all three segments indicating positive movement this quarter.

Term loans form the largest part of MSME credit and remain particularly important for medium enterprises, where they account for more than half of exposure.

"Working capital facilities continue to be the main product for micro and small businesses, and their share stayed largely unchanged compared to the previous quarter," CRIF High Mark said.

Maharashtra remains the largest MSME credit market with outstanding exposure of Rs 7 lakh crore.

The state recorded solid year-on-year growth but a decline of 2.4 per cent during the quarter. Gujarat and Tamil Nadu continue to follow with Rs 4 lakh crore and Rs 3.7 lakh crore respectively as the next largest markets, both showing strong annual and quarterly growth.

Uttar Pradesh and Telangana reported the fastest growth with 5.4 per cent and 6.5 per cent respectively in the September quarter, with both states seeing clear momentum in MSME lending.

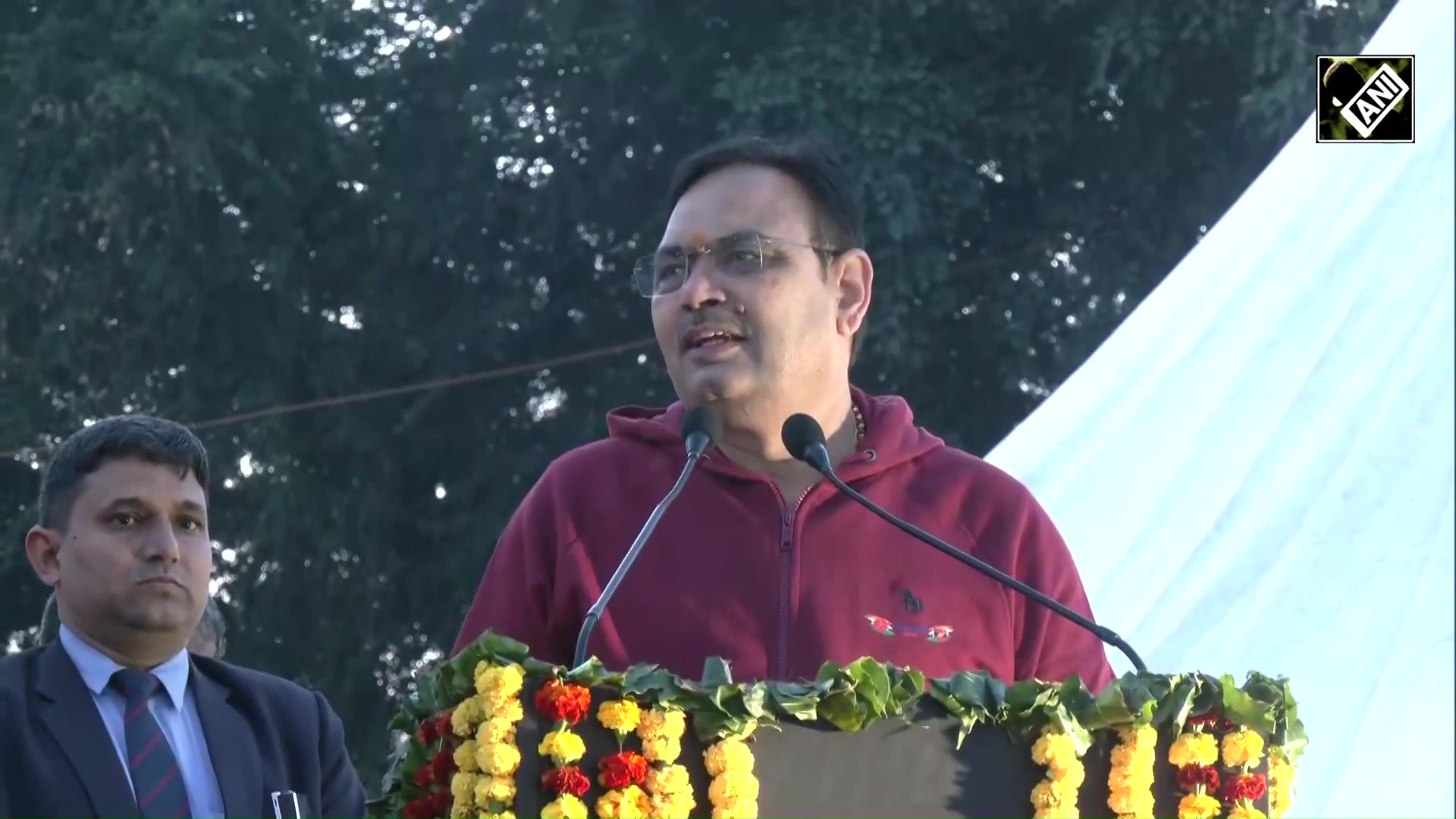

Sachin Seth, Chairman, CRIF High Mark and Regional Managing Director - CRIF India and South Asia, said, "India's MSME credit ecosystem continues to demonstrate resilience with India's broader economic transformation. Our data shows that while micro borrowers remain the backbone in terms of loan volumes, the real credit momentum is shifting toward small and medium enterprises. We are seeing broader participation from lenders and more nuanced risk differentiation, supported by digital infrastructure and policy initiatives aimed at enabling small businesses. MSMEx Spotlight aims to give lenders, policymakers, and ecosystem participants a sharper view of these transitions so they can drive sustainable credit growth."

MSMEx Spotlight is CRIF High Mark's flagship publication on India's MSME credit exposure landscape. Based on granular credit bureau data, it provides a comprehensive view of borrower behaviour, lender trends, portfolio performance, and risk dynamics across micro, small, and medium exposure businesses.