FAI seeks key GST clarifications to alleviate the financial strain on the fertiliser industry

Dec 10, 2025

By Kaushal Verma

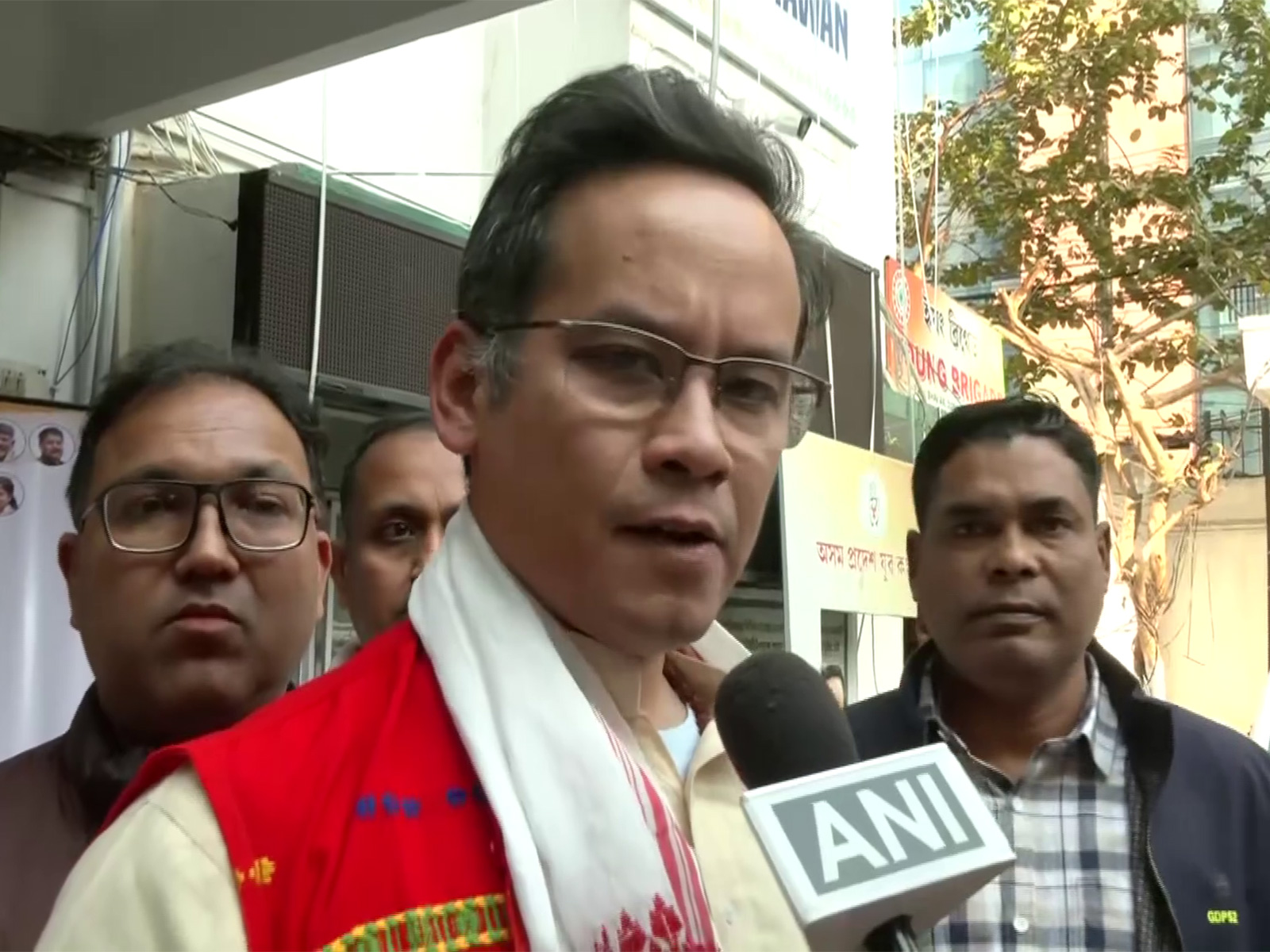

New Delhi [India], December 10 : The Fertiliser Association of India (FAI) is seeking key GST clarifications to alleviate the financial strain on the fertiliser industry, S Sankarasubramanian, Chairman of the Fertiliser Association of India (FAI) told ANI today.

Speaking to ANI, Sankarasubramanian said this would reduce product costs and make fertilisers more competitive as GST-related issues are affecting phosphatic fertilisers.

The FAI Chairman, however, added that recent tax reforms have eased but not eliminated the buildup of unused tax credits.

"See, currently in phosphatic fertilisers, the output fertiliser carries 5 per cent GST and input raw materials, which were at 18 per cent corrected to 5 per cent. Despite the recent cut, the structural distortion persists due to a value inversion. The output value of fertiliser includes a subsidy component that is not subject to GST. This inversion value of the GST leads to credit accumulation for the companies."

Speaking to ANI on the sidelines of the FAI Annual Seminar 2025, Sankarasubramanian appreciated the latest changes made by the finance ministry.

"In the recent GST reforms, the finance ministry has changed the GST on key raw materials like ammonia and sulphuric acid from 18 per cent to 5 per cent. This has been helpful in reducing the credit accumulation," said the FAI Chairman.

He explained that the fundamental mismatch between input and output taxes continues to burden companies.

"The industry has repeatedly sought government intervention. We request the Finance Ministry to issue clarification, and the industry has been represented through the Department of Fertilisers to seek a refund of accumulated credit for the phosphatic fertiliser segment. Hopefully, it should be resolved soon."