For large appliance makers, revenue growth expected to moderate in 2025-26: Crisil

Nov 02, 2025

New Delhi [India], November 2 : Manufacturers of large appliances are expected to see revenue growth moderate to 5-6 per cent this financial year on a high base of 16 per cent logged last fiscal year, according to Crisil Ratings.

According to the rating agency, a sharp cut in demand for cooling products during the first half due to the early onset of monsoon would only see a partial lift-up led by the goods and services tax (GST) cut on AC and large TVs coming in just before the festive season as part of the tax rate rationalisation.

Moderating revenue growth, along with intensifying competition and dearer raw materials, will also shave off 20-40 basis points (bps) from operating margins, the rating agency said this week.

This, however, is unlikely to deter companies from sustaining or stepping up capital expenditure (capex) across categories.

Notably, the AC segment will see a substantially higher capex for compressor capacities as the Bureau of Indian Standards (BIS) norms on imports kick in from April, 2026. Credit profiles will remain stable because of low dependence on debt.

Crisil analysis was based on interactions with seven manufacturers, which account for 50-55 per cent of the Rs 130,000 crore large appliances industry comprising ACs, refrigerators, TVs and washing machines.

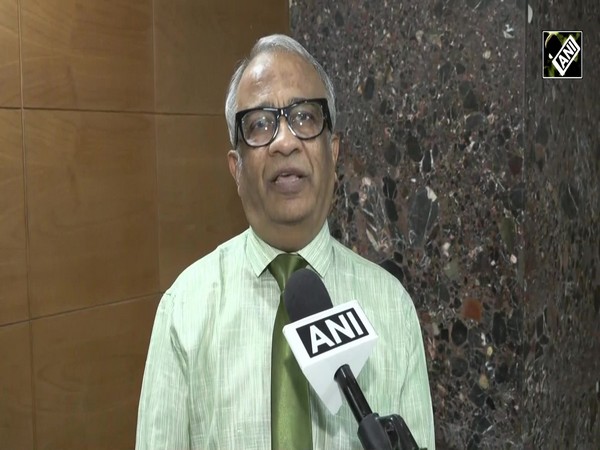

Shounak Chakravarty, Director, Crisil Ratings, said, "The 1000 bps cut in GST to 18% for ACs and large-screen TVs (~58% of sectoral revenue) will translate to savings of Rs 3,000-6,000 per unit."

"For buyers with fixed budgets, this can spur premiumisation. Furthermore, with the price dip coming into effect just before the festive season, increased consumer spending is expected to drive 11-13 per cent growth in the second half, with 100-150 basis points being attributed towards GST benefits. This shall compensate for a low-single-digit de-growth in the first half," Shounak Chakravarty added.

Improving consumer sentiment will also boost consumption in other categories. Refrigerators (31 per cent of sectoral revenue), which witnessed flattish sales in the first half, are likely to see low double-digit growth in the second half, driven by higher demand for larger capacity models due to weekend shopping and increasing consumption of frozen foods.

The washing machine (11 per cent of sectoral revenue) segment was a rare beneficiary of the early monsoon, driven by the need for dryers.

A rising proportion of the working population and changing washing patterns, such as weekend washing, driving demand for fully automatic and larger capacity models, will help maintain growth momentum of 7-8 per cent this fiscal year, Crisil has asserted.

Moderating revenue growth and continuing intense competition will limit meaningful price hikes amid higher input costs such as steel (because of safeguard duty on imports) and aluminium and copper (due to growing demand and supply-side pressures). Consequently, operating margin will reduce slightly to 7.1-7.2 per cent this fiscal year from 7.5 per cent last fiscal year.

"Despite growth moderating from seasonal impact this fiscal year, companies across categories are expected to ramp up capacities given long-term growth potential driven by low penetration of these appliances in India," Crisil believes.

Going forward, volatility in prices of key raw materials such as steel, copper and aluminium, and the extent of competitive intensity in the sector will bear watching, Crisil, however, has cautioned.