Fraud fight tops FATF agenda as global network meets in Mexico City

Feb 14, 2026

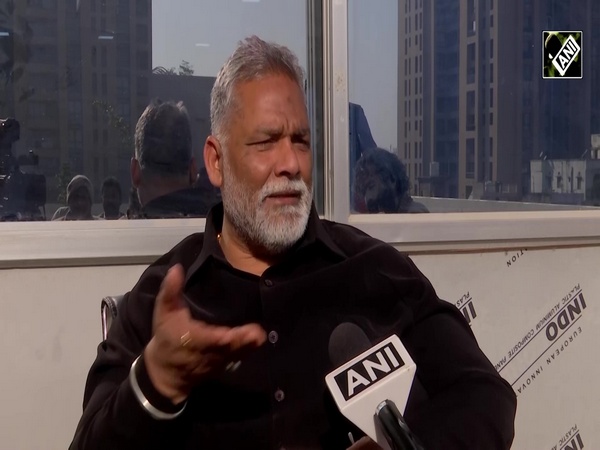

Mexico City [Mexico], February 14 : The Financial Action Task Force (FATF) concluded its fifth plenary under the Mexican presidency this week, drawing more than 600 delegates to Mexico City in what leaders described as a united front against illicit finance.

The plenary approved the FATF's strategic priorities for 2026 to 2028, which will be presented to ministers for endorsement in April. Central to the new agenda is an intensified focus on fraud, now described as an epidemic affecting jurisdictions worldwide.

Citing estimates from the Global Anti-Scam Alliance, the President Claudia Sheinbaum noted that USD 1 trillion was lost to scams globally in a single year. In addition, 90 percent of countries have identified fraud among their top financial crime threats through national risk assessments.

"The Global Anti-Scam Alliance has estimated that one trillion US dollars was lost to scams around the world in just one year. And through our mutual evaluations assessments, we have seen that 90% of countries have identified fraud as one of the key financial crime threats. The fraud epidemic is growing in size, scale and reach and its impact on victims extend well beyond financial loss. The fraud epidemic is growing in size, scale and reach and its impact on victims extend well beyond financial loss," Sheinbaum said.

To address the surge, the FATF agreed on a new paper on cyber-enabled fraud. The document outlines how the organization's standards can be leveraged to counter criminals exploiting instant payments, social engineering tactics and global digital platforms. It also emphasizes cross-border cooperation, real-time intelligence sharing and stronger public-private partnerships.

Two additional reports were approved focusing on developments in the virtual asset sector, including stablecoins and unhosted wallets. According to data referenced during the session, stablecoins accounted for 84 percent of illicit virtual asset transaction volume in 2025. The reports aim to guide countries in licensing, supervising and regulating virtual asset service providers, particularly those operating across borders.

"The first thing I would like to say is that GAFI was the first international body that took action to determine that virtual assets were presenting a risk to money laundering and financing terrorism. This does not mean that all virtual assets are used in an illicit way or for illicit purposes, but a risk has been detected since 2014, and by 2018 we had already issued a recommendation and the interpretive note in 2019," Sheinbaum said.

Delegates highlighted operational successes as well. Through the Frontier Plus platform, 11 jurisdictions coordinated a large-scale anti-scam operation last year, processing more than 9,000 scam reports tied to losses exceeding EUR192 million. Authorities made over 1,800 arrests and seized more than EUR17 million in assets.

The plenary also reviewed progress on its "gray list" and "black list." Twenty-one countries reported on reforms to strengthen their defenses against money laundering and terrorist financing. Kuwait and Papua New Guinea were added to the gray list due to strategic deficiencies, while updates were issued regarding Iran.

In addition, mutual evaluation reports for Italy, Austria and Singapore were approved, following extensive on-site assessments that tested the effectiveness of national frameworks in combating illicit finance.

Marking the anniversary of its report on online child sexual exploitation, the FATF shared that 75 percent of surveyed countries have incorporated the crime into their national risk assessments, and one-third reported increases in suspicious transaction reports linked to the offense.

Looking ahead, the plenary elected Giles Thompson of the United Kingdom as incoming president. The current president reaffirmed her commitment to advancing the organization's priorities through June 2026.

"I will be pleased to leave the FATF in Giles' very capable hands when he takes up the position in July of this year for a two-year presidency. In my remaining months in the presidency until June of 2026, I am committed to continue to work with all countries and partners across the global network towards strengthening our collective fight against illicit finance. This year marks 26 years since Mexico joined the FATF," the Mexican President said.

"This year marks 26 years since Mexico joined the FATF," she said, calling it "an honour to be sharing this update with you from my home country."