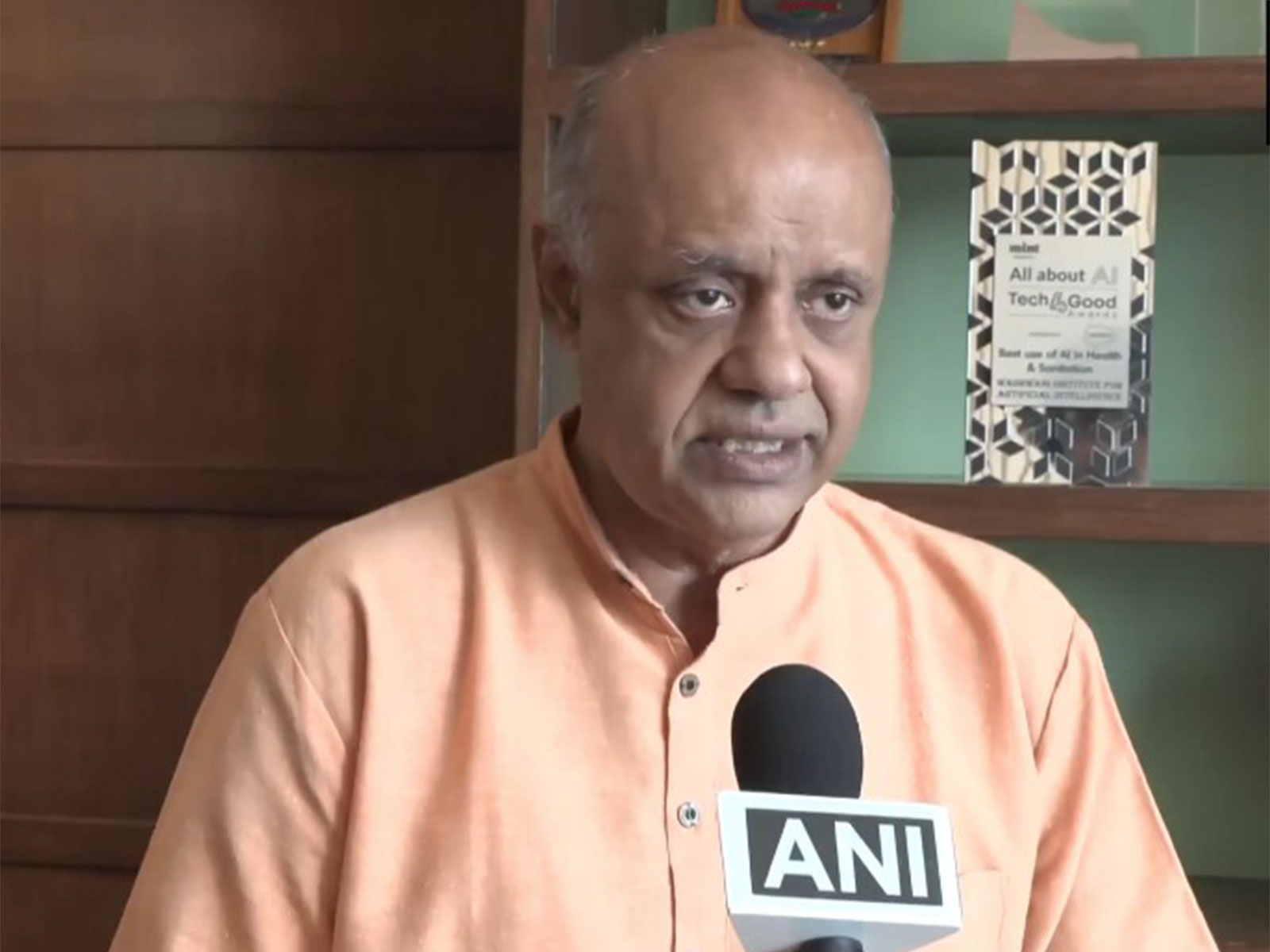

Import curbs on Low Ash Metallurgical Coke raise steel prices in India: GTRI

Dec 26, 2025

New Delhi [India], December 26 : The import curbs on Low Ash Metallurgical Coke, which accounts for 35-40% of steel production costs, raise steel prices in India, Global Trade Research Initiative (GTRI) said in a report on Friday.

The report highlighted that India's dependence on imported low-ash coke is structural, as most of domestic coal has 14-15% ash and cannot fully support efficient blast furnace steelmaking.

"While the government protects domestic steelmakers through high safeguard and anti-dumping duties and Quality Control Orders on finished steel imports, it simultaneously restricts access to Low Ash Metallurgical Coke (LAM Coke), a non-substitutable input that accounts for 35-40% of steel production costs," the report said.

By capping volumes and imposing high duties on this essential input, policy intended to support steel producers is instead raising costs, eroding competitiveness, and choking capacity expansion. In steel, as in growth, misaligned input and output regulations work against national economic objectives, it added.

Over the past 1 year, the report said, India has progressively tightened controls on LAM Coke imports through safeguard measures, quantitative restrictions, and provisional anti-dumping duties, creating a double barrier on both volumes and prices.

A safeguard investigation in 2023 led to import caps, followed by country-wise QRs from January 2025 limiting imports to 1.4 million tonnes per half-year, a ceiling subsequently extended through December 2025. In parallel, an anti-dumping investigation covering Australia, China, Colombia, Indonesia, Japan, and Russia resulted in provisional duties of $60-$120 per tonne in November 2025, it said.

A major flaw in the anti-dumping exercise is freight benchmarking. LAM Coke is shipped almost entirely as dry bulk, with freight costs around USD 20-25 per tonne, but the investigation reportedly used container freight benchmarks, 810 times higher, artificially inflating landed values and dumping margins. This has pushed duties above what actual trade economics justify.

The impact is visible. In the first half of 2025, steelmakers secured only about 1.5 million tonnes of met coke against demand of over 3 million tonnes, forcing reliance on uneven domestic supply and raising the risk of production cuts.

Since LAM Coke makes up roughly 38% of finished steel costs, a 20-25% rise in coke prices translates into a 3-5% increase in steel prices, squeezing margins and hurting competitiveness at home and abroad, GTRI said.

Highlighting its suggestion to the government in this direction, GTRI said, "As QRs near expiry at end-2025, India should restore predictable and adequate access to LAM Coke by lifting or sharply expanding quotas, avoiding overlapping controls, and recalculating duties using realistic dry-bulk freight."

"Protecting domestic metcoke producers is valid, but stacking quotas and duties on a non-substitutable input risks over-correction and macroeconomic consequences," it added.