India working on multilateral tax certainty framework, says principal commissioner Income Tax

Nov 07, 2025

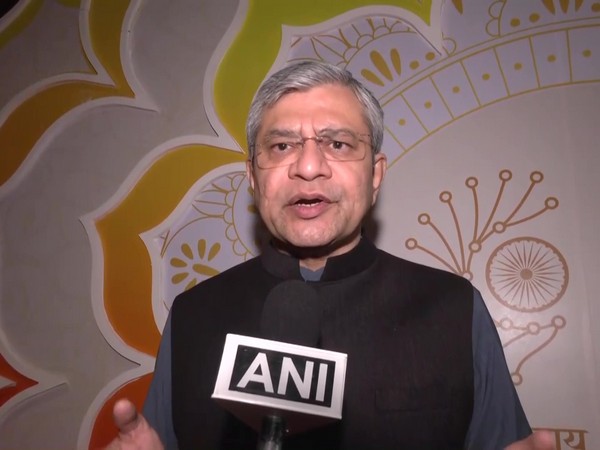

New Delhi [India] November 7 : India's recent tax reforms have strengthened investor confidence and reduced uncertainty, and the next phase of reforms will now focus on achieving "multilateral certainties", Principal Commissioner of Income Tax Raman Chopra said today.

"Multilateral certainties are required and we are working on them as a continuous process. Once the decision is taken and when it has to come, it will certainly come forward," he said, referring to the multilateral tax certainty framework, on the sidelines of the International Tax Summit in New Delhi.

Chopra further emphasised the ongoing international discussions on Pillars 1 and 2, including the US reservations on UTPR, and emphasized India's commitment to tax certainty, simplified compliance, and a non-intrusive tax administration. The last 10 years have seen an immense.

He emphasised that while domestic legislation has made compliance smoother, aligning India's tax system with global frameworks remains a continuous priority.

"Our domestic legislation has done everything possible to remove uncertainty, resolve taxpayers' problems, and improve infrastructure. Many provisions have been brought into the statute in the last five years that have improved certainty," Chopra said, underscoring how domestic reforms have provided stability and encouraged investment, especially in infrastructure.

Calling the February budget a "landmark," Chopra said it delivered unprecedented relief to taxpayers.

"Such a huge relief to the common taxpayers has never been given in any budget. Once we have taken the limit to Rs 12 lakh, it's a huge amount of money and that's going to fuel the economy," he said.

He added that the full benefits would unfold over the next two years as the next pay commission's recommendations take effect.

On whether income tax collections are rising, Chopra pointed to increased compliance through data-driven monitoring.

"Through third-party information collection, we have identified many new areas, and that information is being shared with taxpayers. It's a non-intrusive and voluntary compliance mechanism given by the government," he explained, crediting transparency for expanding the tax base.

"Everybody is beginning to pay the tax, and it has increased that base and deepened it also," he said.

He said that policymaking will continue to prioritise taxpayers."The proposals that users take to policymakers are considered very seriously. Any proposal that goes forward now will be consumer-centric and beneficial, it will definitely be considered," he said.

Speaking at the summit, Chopra highlighted the growing global concern around base erosion and profit shifting (BEPS), explaining how the rise of the digital economy has intensified challenges of tax base protection for market jurisdictions.

He further spoke about the growing relevance of transfer pricing, the significant rise in APAs, and the government's continued focus on safe harbour provisions, especially for sectors requesting certainty.