Indian stock market ends on muted note; IT stocks remain key support

Dec 18, 2025

Mumbai (Maharashtra) [India] December 18 : Domestic benchmark indices on Thursday ended on a muted note in the volatile trade with Sensex down 77.84 points or 0.09% at 84,481.81, and the Nifty was down 3 points or 0.01% at 25,815.55.

IT stocks remained the key support for the Sensex while select heavyweights including HDFC Bank, Sun Pharma, and Bharti Airtel remained the top drags.

Among the sectors, IT index rose 1% while the realty rose 0.3%. On the other hand, auto, media, pharma, oil & gas, Capital Goods declined 0.3-1%.

On NSE, 49 shares touched their 52-week high while 228 shares touched their 52-week low in trade.

Out of 3209 stocks that traded on the NSE, 1237 advanced, 1827 declined, and 109 remained unchanged.

Market sentiments remained subdued due to the weak global cues and lack of fresh triggers.

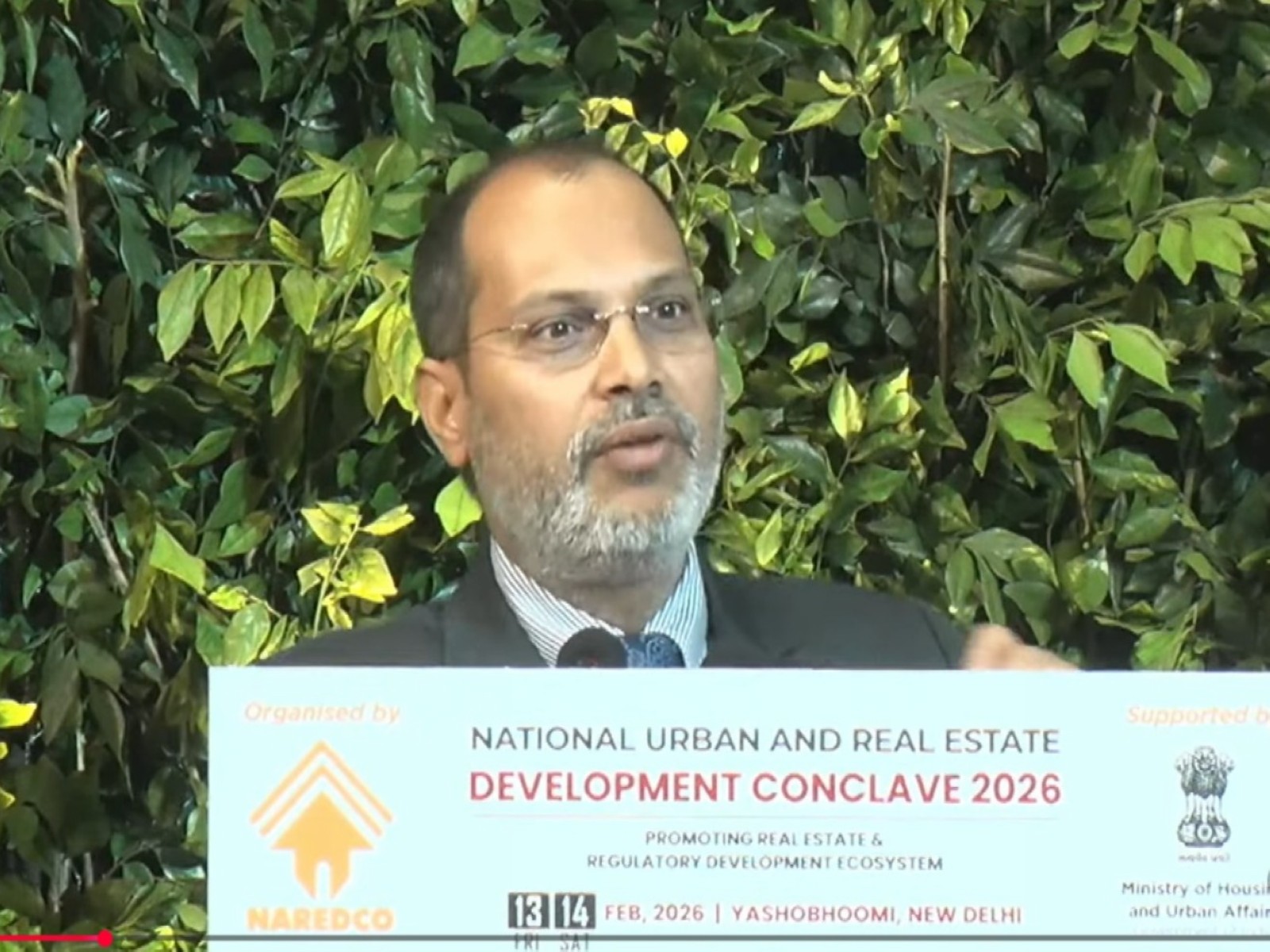

Nilesh Jain, Head - Technical and Derivatives Research Analyst (Equity Research), Centrum Broking Ltd said, "The markets stayed under pressure for the fourth straight session, with the Nifty continuing to form lower highs and lower lows on the daily chart. It closed marginally below its 50-day moving average, placed around 25,820, which is expected to act as an immediate resistance, followed by the 26,000 level."

"Overall market breadth showed slight improvement, as the broader indices outperformed the benchmarks. Given the recent correction and the Nifty testing its key support near 25,700, there is a possibility of a pullback. On the upside, a sustained move above the short-term 21-day moving average at 26,000 would be critical to initiate such a recovery," he added.

Rupak De, Senior Technical Analyst at LKP Securities said, "The Nifty remains weak as the index failed to reclaim the 200-DMA on the hourly chart, with bears continuing to drag Indian equities lower. The formation of continuous lower tops further reinforces the bearish outlook. The trend continues to remain weak, with the 25,700 level appearing vulnerable to a breakdown. A decisive breach below 25,700 could trigger a swift next leg of correction. On the upside, resistance is placed around 25,900."