Indian stocks to exhibit resilience in 2023; EV, defence, infra in focus: Windmill Capital

Jan 07, 2023

New Delhi [India], January 7 : Continuing the trend from 2022, the Indian stock markets is expected to continue to exhibit resilience this year, according to Windmill Capital, a research analyst and the subsidiary of Smallcase Technologies.

The positive outlook for 2023 is despite concerns emanating from the global slowdown and a possible recession in the Western economies due to the unwinding of monetary policy by central banks.

In 2022, in comparison to most other global markets, the Indian markets have managed to be in positive territory with 3 percent gains.

Returns in most other markets, including the US, China, Hong Kong, Germany, Australia, Japan, Korea, and France, were negative in 2022, Windmill Capital data showed. Markets in the UK gave just about one percent return.

The reason behind India's outperformance, Windmill Capital said, could be attributed to the government's proactive policies in managing multiple crises including the Russia-Ukraine issue.

At a time when the world was levying an embargo on Russian oil, the Indian government saw an opportunity and started sourcing oil from Russia at a much cheaper rate.

Also, the withdrawal of gradual "normalization" of monetary policy by RBI has prevented the equity markets from a sudden shock.

"We expect the secular growth to continue for the Indian equity market as most of the pain in terms of rate hike, deficit is factored in. Geopolitical tensions, recent resurgence of COVID-19 cases in China, and the rate action by the Fed will guide markets, currencies and crude oil prices," said Naveen KR, smallcase manager and senior director at Windmill Capital.

"Although inflation has begun to trend down, there is no surety that it will be under total control going forward and that is something to watch out for. A slowdown in the West will have a maximum bearing on the Indian IT and exports sector."

Naveen KR added the government should continue its reforms in 2023, and present a fiscally responsible Budget.

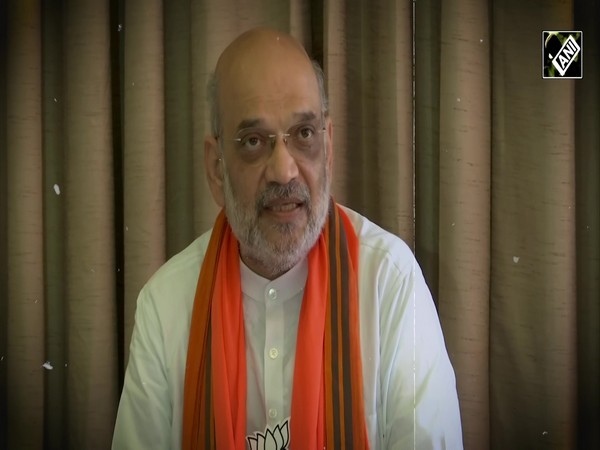

Budget 2023 is likely to be the last full budget of the Modi government in its second term with the next Lok Sabha elections due in April-May of 2024.

Specialty chemicals: The sector is set to benefit from the China + 1 strategy and the possibility of coverage under the PLI scheme.

Electric mobility - The government's push has moved the needle and a lot of incentives have been provided in order to nudge the common public folks to buy an EV.

Infrastructure - A strong impetus from government policies is one of the main growth drivers for the infrastructure industry in India, coupled with a strong capital expenditure environment.

Auto - The pain points around the supply side have been easing out for automotive manufacturers. Additionally, the demand pipeline for auto companies is very strong, further adding to the confidence in this sector.

Banking - Strong credit off-take in tandem with rapid asset quality improvement is a deal maker for the sector. Deposit rates have also been healthy for major private players.

Defence - India's military spending is the third largest in the world with the 2022-23 Budget pegging it at USD 54 billion. Until five years ago, India was largely importing its defence needs.

However, the government's focus has shifted towards indigenization, wherein domestic players are not only servicing domestic orders but also exporting overseas, which has led to a surge in exports.