India's outward FDI flows higher than world average over past 5 years: Bank of Baroda report

Sep 01, 2025

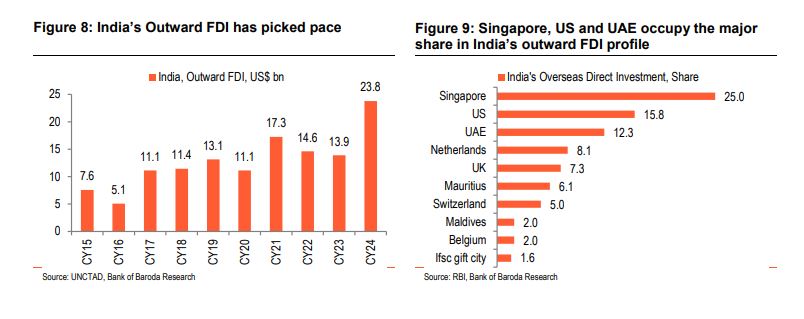

New Delhi [India], September 1 : India's outward FDI flows have increased at a sharp pace in the past 5 years, recording a five-year CAGR of 12.6 per cent, which is higher than the world average of 3.9 per cent, according to a report by Bank of Baroda.

The report, authored by economist Dipanwita Mazumdar, attributed this growth to efforts towards integrating into the global investment cycle to tap newer markets. In 2024, India's outward FDI reached a record high level of USD 23.8 billion, the report said.

The country-wise profile gives a closer picture about direction of India's outward FDI flow. Singapore accounts for 25 per cent of India's outward FDI since 2015, followed by the US and the UAE, according to the report.

The outward FDI profile for India is still considerably diversified.

"In terms of destination country for outward FDI of India, it is more diversified than majority of other countries. Hence it doesn't pose much immediate risk under the volatile global policy space," the report read.

The report gives a broad perspective of global investment flows looked at from the angle of outward FDI flows. The direction and concentration of outward FDI becomes crucial at this juncture when a lot of countries have made significant investment pledges to the US, it has asserted.

This report come on the back of investment intentions expressed by several countries to the US, to avert US reciprocal tariffs. A host of countries have pledged to invest significant amount in the US to deepen its trade and economic ties.

In most countries, the amount is expected to span over a period of next three years or the next decade. Also since these are investment intentions, numbers should be read with caution as the entire amount might not be translated into actual FDI flows.

Amongst them, the amount pledged by UAE is the highest followed by Qatar and Japan, the Bank of Baroda said. For most of the countries, investment is expected to be in sectors such as US energy, defence, aviation, auto and technology.