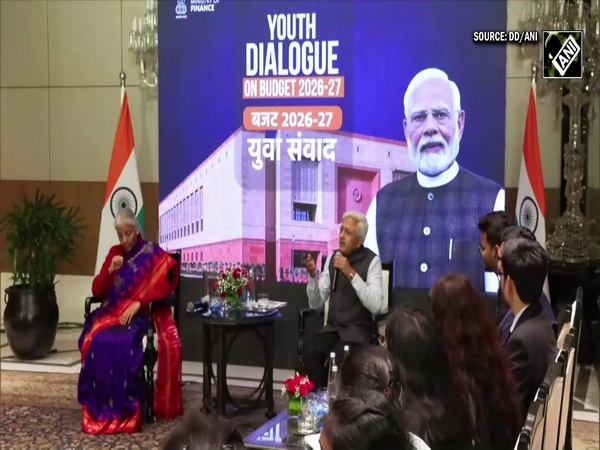

Industry experts laud India-US trade deal, call it win-win for economy, markets

Feb 02, 2026

New Delhi [India], February 3 : Following the announcement of the India-US trade deal, where Washington reduced the tariffs on India to 18 per cent, industry leaders, market experts and economists on Tuesday welcomed the deal, terming it a historic and win-win agreement that will boost bilateral economic ties between the two nations, improve market sentiment and strengthen India's position in global trade.

Ashish Chauhan, Managing Director and CEO of the National Stock Exchange of India (NSE), described the agreement as a welcome move for global trade, noting that the tariffs on Indian goods would come down sharply with immediate effect.

In a post on X, the MD and CEO of the NSE said that the deal would be a big win for businesses, supply chains and the India-US partnership.

"Welcome move for global trade! Congratulations! After today evening's talks between the US President Mr Donald Trump and the Indian Prime Minister, Shri Narendra Modi, tariffs on Indian goods coming down sharply from 50% to 18% with immediate effect. A big win for businesses, supply chains, and the India-US partnership. Kudos to the teams involved in bringing this historic deal to a close," his post read.

Chairman of the 16th Finance Commission, Arvind Panagariya, also welcomed the development, praising the leadership involved.

In a post on X, Panagariya said that two of the world's toughest negotiators had reached an agreement, calling it both the "father and mother of all trade deals", and congratulated Prime Minister Modi on the outcome.

"Bravo! Two of the world's toughest negotiators come to an agreement. So, we have both the father and mother of all trade deals! Congratulations Prime Minister! India is unstoppable under your leadership!!" his post read.

Meanwhile, market participants said the deal would have far-reaching implications for Indian companies and the broader economy.

Shashank Udupa, a SEBI-registered research analyst and fund manager at Smallcase, said the agreement was a net win for India and would help remove the disadvantages of not having a trade deal with the US, noting that India had remained firm on protecting its dairy and agriculture sectors while agreeing to increased energy purchases from the US.

He also stated that securing trade deals with both the US and the European Union, which concluded last month during the state visit of European Council President Antonio Costa and European Commission President Ursula von der Leyen, within a short span would support India's push towards becoming a manufacturing-led economy.

"The deal is a net win-win for everyone," the analyst said.

"India has always been very clear that we won't expose our Dairy and Agri sector. PM Modi has defended that stance, and finally, we had to agree with the US on buying energy from them worth 500 Billion Dollars, where India will now start buying oil, coal and some agricultural products. Having a Deal today at such low tariffs, cheaper than many of our Asiancounterparts willl surely boost our company's profits. We have basically secured two amazing trade deals in a span of 2 months - with the USA and the EU... Overall, a Net win for INDIA," he added.

Sonam Srivastava, Founder and Fund Manager at Wright Research PMS, said the reduction in tariffs under the trade deal is a meaningful positive for Indian equities, both in terms of sentiment and earnings visibility. Srivastava added that export-orientated sectors such as IT services, pharmaceuticals, speciality chemicals, auto ancillaries and engineering goods are likely to benefit the most from improved competitiveness in the US market.

"The reduction in tariffs from 25% to 18% under the newly signed India-US trade deal is a meaningful positive for Indian equities, both from a sentiment and earnings visibility standpoint. The sharp ~600-point surge in GIFT Nifty reflects an immediate repricing of risk, driven by expectations of improved trade competitiveness, lower input costs for exporters, and stronger bilateral economic alignment between the two countries," the founder said.

"From a sectoral lens, export-oriented segments such as IT services, pharmaceuticals, speciality chemicals, auto ancillaries, and select engineering goods stand to benefit the most. Lower tariff barriers improve price competitiveness for Indian firms in the US market, which remains India's largest export destination. Over time, this could translate into better order inflows, margin stability, and higher capacity utilisation. Domestic manufacturing themes tied to global supply chain diversification also get reinforced," she added.

"At the broader macro level, Srivastava further stated that agreement reflects consistency in India's trade strategy and reinforces its standing as a preferred partner amid shifting global trade dynamics.

She stated that while the immediate market response has been strong, its durability will hinge on effective execution, sector-wise adoption, and follow-through in earnings upgrades.

Sachin Sawrikar, Managing Partner at Artha Bharat Investment Managers IFSC LLP, said the agreement strengthens one of the world's most consequential economic partnerships by improving market access and reducing policy uncertainty and added that stronger bilateral trade could drive higher cross-border investment flows, deepen institutional participation and support the Indian rupee over the medium term, while reinforcing positive equity market sentiment.

"The India-US trade agreement is a decisive development that strengthens one of the most consequential economic partnerships globally. By improving market access and reducing policy uncertainty, the agreement creates a more investable environment for capital deployment across sectors. Stronger bilateral trade is expected to drive higher cross-border investment flows, deepen institutional participation, and accelerate the integration of Indian companies into global supply chains," Sawrikar said.

"From a market perspective, this should be supportive of the Indian rupee over the medium term through stronger trade and capital inflows, while reinforcing positive sentiment across equity markets, particularly in export-orientated and manufacturing-linked sectors," he added.

Meanwhile, Nilesh Shah, Managing Director at Kotak Mahindra Asset Management Company, said the India-US trade deal had seen several ups and downs, but its conclusion removes a major overhang on the rupee, equity and interest rate markets.

He also expressed hope that the agreement would prove to be a win-win for both countries, given the significant gains possible through closer cooperation.

The remarks come after Trump said that the US and India "have agreed to a trade deal" with Washington reducing the reciprocal tariff from 25 per cent to 18 per cent "out of friendship and respect" for PM Modi. He further stated that the deal will come "effective immediately".

In his Truth Social post, Trump referred to his conversation with PM Modi earlier on Monday, noting that the Prime Minister was one of his closest friends and a powerful, respected leader of the country.

The US President also said PM Modi had agreed to "stop buying Russian oil" and to buy much more from the US.

Trump further noted that India would reduce tariffs and non-tariff barriers against the US.

"It was an Honor to speak with Prime Minister Modi, of India, this morning. He is one of my greatest friends and, a Powerful and Respected Leader of his Country. We spoke about many things, including Trade, and ending the War with Russia and Ukraine. He agreed to stop buying Russian Oil, and to buy much more from the United States and, potentially, Venezuela. This will help END THE WAR in Ukraine, which is taking place right now, with thousands of people dying each and every week! Out of friendship and respect for Prime Minister Modi and, as per his request, effective immediately, we agreed to a Trade Deal between the United States and India, whereby the United States will charge a reduced Reciprocal Tariff, lowering it from 25% to 18%. They will likewise move forward to reduce their Tariffs and Non Tariff Barriers against the United States, to ZERO," Trump's post read.

"The Prime Minister also committed to "BUY AMERICAN," at a much higher level, in addition to over $500 BILLION DOLLARS of U.S. Energy, Technology, Agricultural, Coal, and many other products. Our amazing relationship with India will be even stronger going forward. Prime Minister Modi and I are two people that GET THINGS DONE, something that cannot be said for most. Thank you for your attention to this matter!" he added.

Following Trump's post, Prime Minister Narendra Modi, in a post on X, said that it was wonderful to speak with his "dear friend President Trump" and expressed delight that "Made in India products will now have a reduced tariff of 18%".

"Wonderful to speak with my dear friend President Trump today. Delighted that Made in India products will now have a reduced tariff of 18%. Big thanks to President Trump on behalf of the 1.4 billion people of India for this wonderful announcement," PM Modi wrote in a post on X.

The Prime Minister also said that cooperation between the two major economies and the world's largest democracies serves the interests of their people and opens up vast opportunities for mutually beneficial collaboration.

"When two large economies and the world's largest democracies work together, it benefits our people and unlocks immense opportunities for mutually beneficial cooperation. President Trump's leadership is vital for global peace, stability, and prosperity. India fully supports his efforts for peace. I look forward to working closely with him to take our partnership to unprecedented heights," the Prime Minister added.