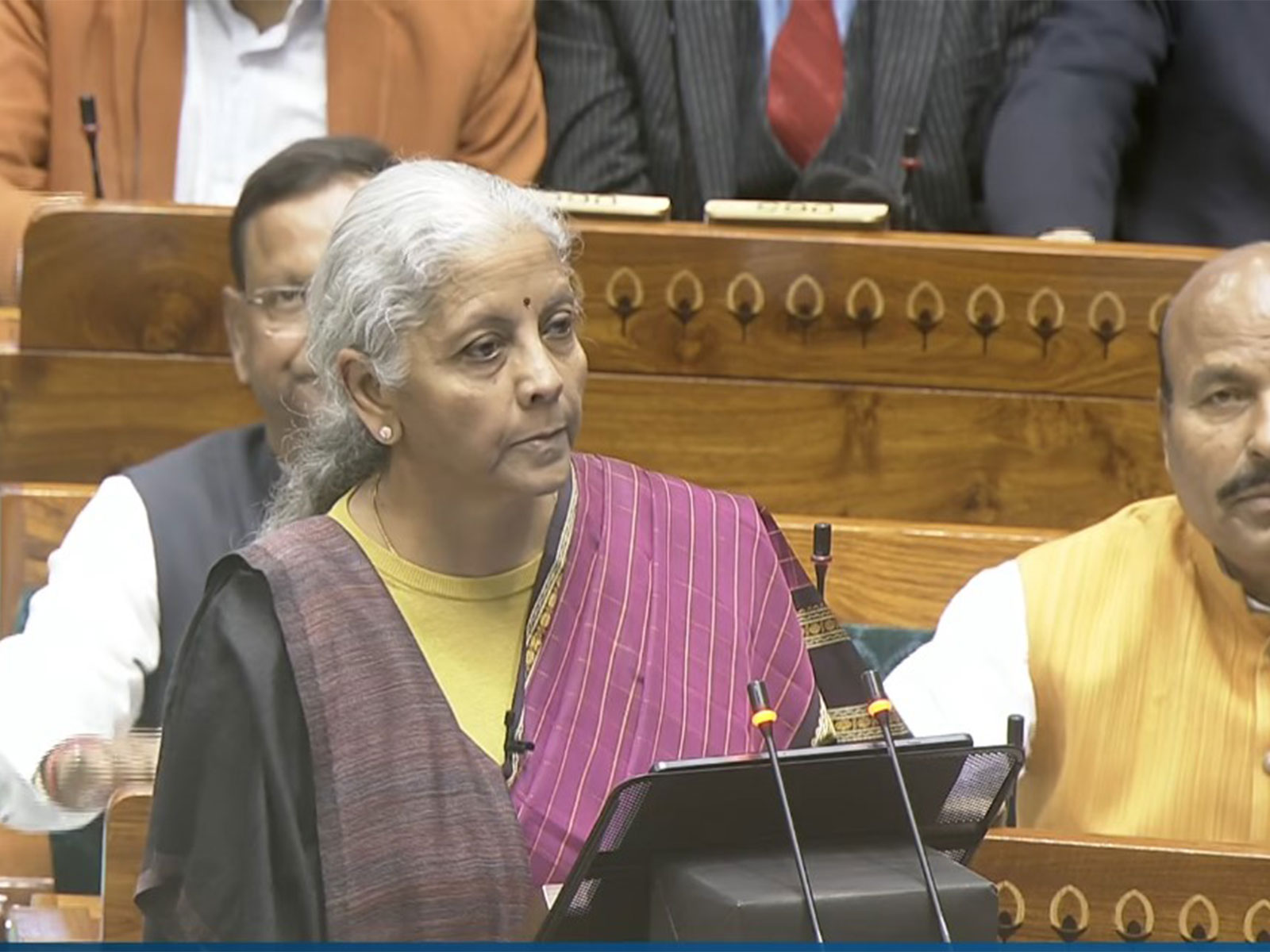

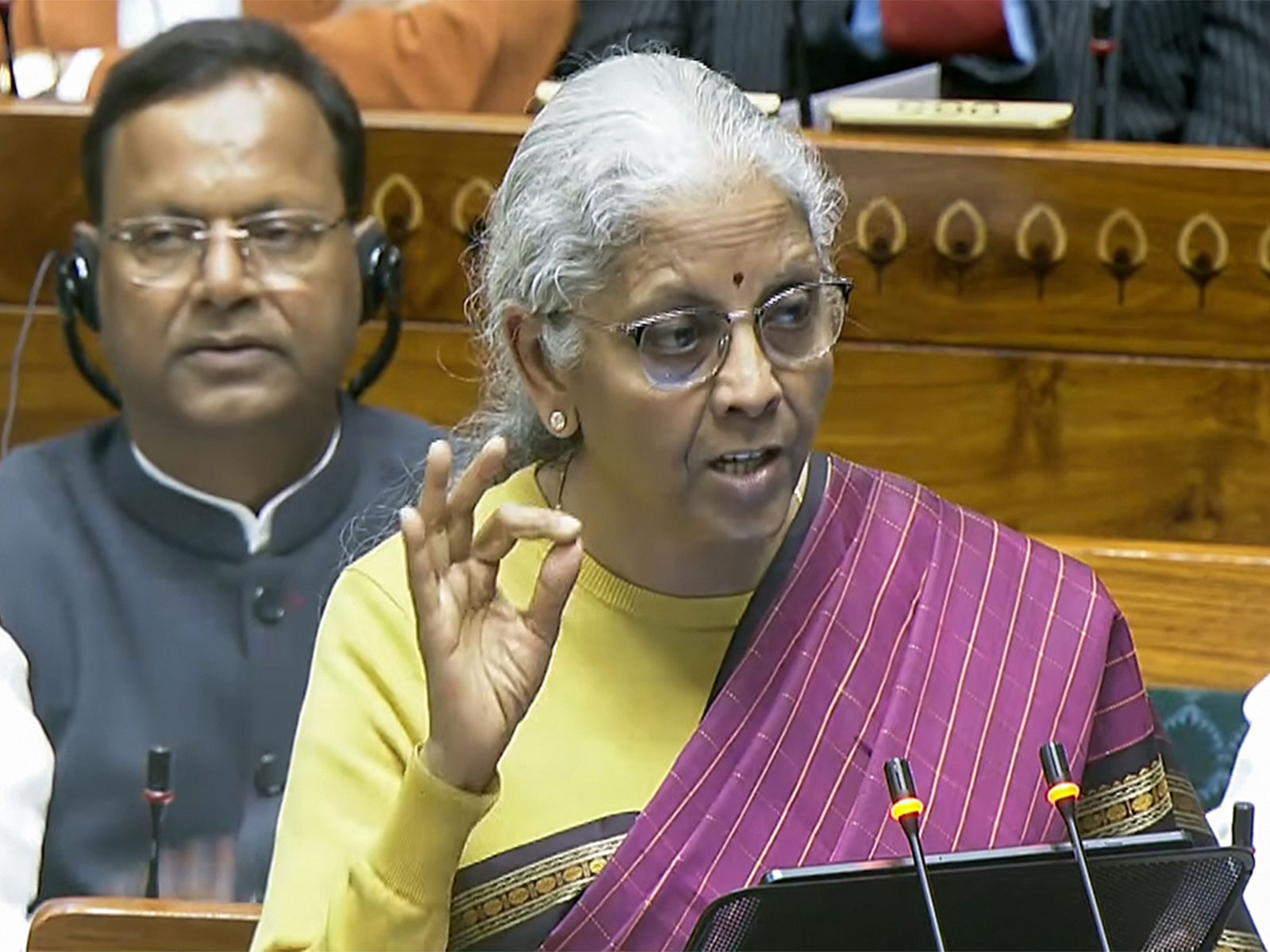

Industry leaders welcome Budget 2026, see strong push for infrastructure, MSMEs and inclusive growth

Feb 01, 2026

New Delhi [India], February 1 : Industry leaders across real estate, finance, manufacturing and capital markets have largely welcomed the Union Budget 2026, calling it growth-oriented, people-centric and supportive of long-term economic resilience, with a strong thrust on infrastructure, urban development and MSMEs.

Parveen Jain, President of NAREDCO, said the government's decision to raise capital expenditure from Rs 11.2 lakh crore to Rs 12.2 lakh crore for FY 2026-27 is a forward-looking step.

He said, "A special focus on cities with a population of over five lakhs is a far-sighted move towards balanced urban development. This will act as a strong booster for real estate activity in Tier-2 and Tier-3 cities and accelerate urbanization".

Sarbvir Singh, Joint Group CEO of PB Fintech, described the Budget as a "genuine aam aadmi ka Budget."

He said, "A strong push towards manufacturing in India anchors the Budget's growth strategy, recognising its role in job creation, supply chain resilience and exports. This is complemented by people-first measures, such as exempting interest awarded by Motor Accident Claims Tribunals from income tax, ensuring that compensation intended for accident victims and their families is received in full".

Ayush Lohia, CEO, YOUDHA said "Budget 2026 sends a strong and timely signal to India's EV and clean mobility ecosystem. The continuation of customs duty exemptions on capital goods and lithium-ion cell components, along with incentives for critical mineral processing, will significantly reduce manufacturing costs and strengthen domestic value chains. These measures will help accelerate scale, improve global competitiveness, and reinforce India's ambition to emerge as a self-reliant hub for advanced battery and EV manufacturing."

Highlighting measures for small businesses, Sajja Praveen Chowdary, Director at Policybazaar for Business, said the proposed Rs 10,000 crore SME Growth Fund would address the long-standing challenge of equity funding for growth-stage MSMEs.

He said "For growth-stage MSMEs, funding equity has always been a long standing challenge and this move will go a long way in developing robust and resilient sector champions. To keep the smallest players afloat, the Self Reliant India Fund will get Rs 2,000 crore top up".

Piyush Lohia, Director, Lohia Worldspace, said the Budget sends a positive signal for real estate and infrastructure.

He said "The government will spend money, Rs 12.2 lakh crore on public projects. This should help get things done faster and make it easier to get around and finish projects on time. So the government spending money on infrastructure is a thing for people who want to buy homes. The Union Budget 2026 and its plans for infrastructure will help people feel confident about buying homes. The government has decided to create companies called REITs for the land owned by Central Public Sector Enterprises. This is an idea because it will help use land that is not being used properly and it will also make the commercial real estate market stronger"

Samantak Das, Chief Economist and Head of Research & REIS, India at JLL, said the Budget's three-pronged focus on growth sectors, infrastructure and services provides a clear blueprint for sustaining economic growth.

He said "Specific incentives for biopharma and electronics manufacturing, rare earth mining, setting up education townships & medical value tourism hubs are far-reaching. Additionally, the measures to promote tourism will create accretive employment and revenues while the tax holiday for foreign data centre service providers is set to make India a global hub for data centres".

Manu Sehgal, CEO of Brickwork Ratings, said incentives for large municipal bond issuances will strengthen urban infrastructure financing.

He said "The securitisation of TReDS receivables and the SME Growth Fund together strengthen credit access for MSMEs and reinforce the shift toward market-based financing. Together, these measures strengthen debt markets, improve credit flow to productive sectors."