L&T lists India's first ESG bonds worth ₹500 crore on NSE

Jun 23, 2025

Mumbai (Maharashtra) [India], June 23 : Infra and technology company Larsen & Toubro (L&T) has listed India's first ESG bonds on the National Stock Exchange (NSE), setting a precedent for a greener and more sustainable financial future in India.

In a statement, the company said it has successfully raised Rs 500 crore through Non-Convertible Debentures (NCD) at a coupon rate of 6.35 per cent under the Securities and Exchange Board of India's (SEBI) newly introduced ESG (Environment, Social and Governance) and sustainability-linked bond framework.

The NCDs, having a three-year maturity period, will mature on June 19, 2028, and the interest would be paid on an annual basis.

"Issued in partnership with HSBC, who served as the sole lead arranger, this landmark transaction adheres strictly to SEBI's regulatory guidelines introduced on June 5, 2025, aimed at enhancing transparency and accountability among bond issuers," the company said.

The framework mandates key disclosures, including sustainability objectives, external evaluations such as Second-Party Opinions (SPOs), and continuous postissuance reporting, with clear Key Performance Indicators (KPIs) to measure ESG impact.

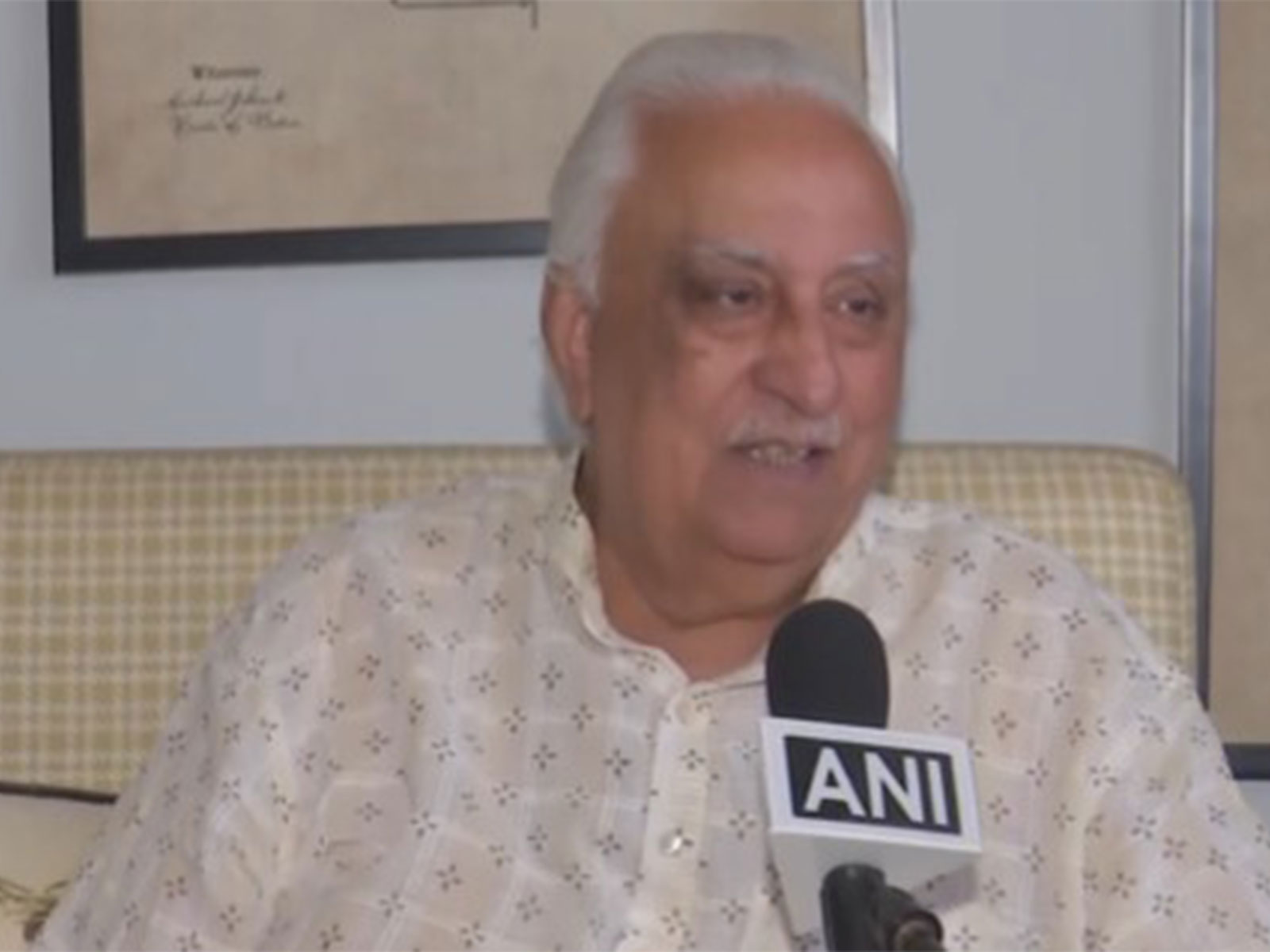

Commenting on the listing, R Shankar Raman, President, Whole-time Director and CFO, L&T said, "We are proud to lead India's transition to sustainable finance through this pioneering ESG bond listing. This initiative underlines our dedication to long-term sustainable development and positions us at the forefront of responsible corporate governance and environmental stewardship."

"This deal reinforces our commitment to driving L&T's ESG goals and supporting the larger energy transition objective," R Shankar Raman added.

The company added this successful issuance is a significant milestone in India's financial markets, illustrating growing investor appetite for ESG-compliant financial instruments and setting a benchmark for future sustainable financing ventures.