NPS suffering under new tax regime, needs tax benefit of Rs 50,000 under 80 C in coming Budget: Axis Pension CEO

Dec 30, 2025

By Kaushal Verma

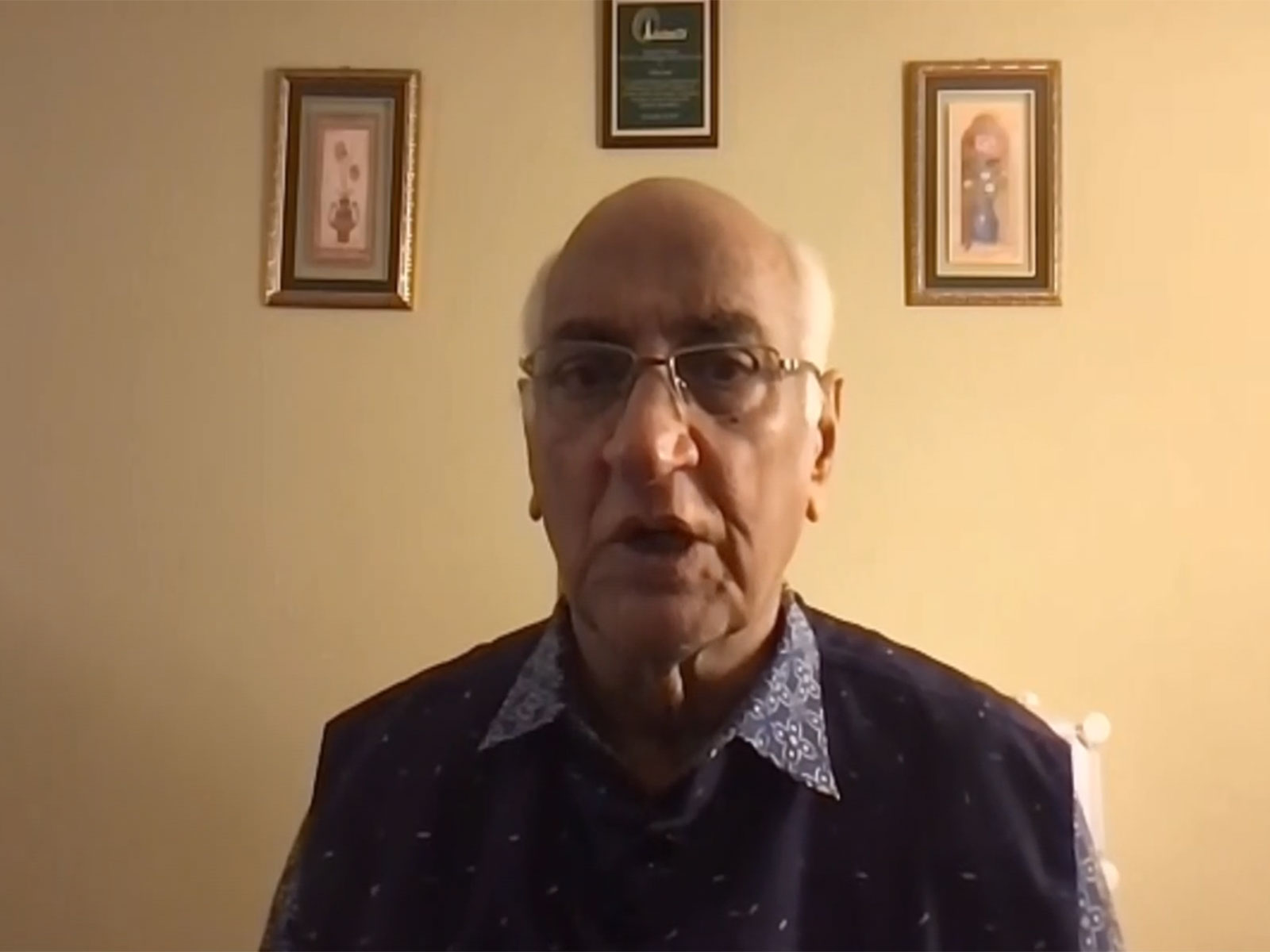

Mumbai (Maharashtra) [India] December 30 : The pension industry has requested the government to restore the additional Rs 50,000 tax benefit for the National Pension System (NPS) under the new tax regime in the upcoming Union Budget as the incentives are critical to widen coverage beyond salaried Indians, Axis Pension Fund CEO and Managing Director Sumit Shukla told ANI today.

"Tax benefit of 50,000 under 80 C should come to NPS for new tax regime. The recommendation has gone from industry to government," Shukla told ANI in an exclusive interview, adding that "Today, NPS is suffering because we used to have 50,000 rupee tax benefit in old tax regime but that's gone in new tax regime."

He said that if somebody wants to open an NPS account and 50,000 rupees was given exclusively for NPS over and above 1.5 lakhs in Section 80C. However, in the new tax regime, that has gone away. So, any effort from the government side has to be backed up.

"And I think we would ask the government to look at bringing back that 50,000 rupees tax benefit which was available for NPS. And any scheme will become popular as more and more incentives is given to the customers to enroll for those accounts and open their account," he said.

Shukla said the pension sector is in the middle of a fast-moving reform cycle. "So, actually, the pension sector is going through quite an overhaul. And a lot of things are getting changed quite rapidly... some radical changes are being proposed," he said, pointing to new rules that allow pension fund managers to create multiple schemes for different cohorts.

"This is a new concept of allowing the pension funds to launch their own schemes... So, idea is we can create our own schemes for our set of customers. Maybe somebody would want to like to create it for, you know, women... working adults," he said, adding: "Focus is on driving those schemes to scale up quickly."

He also flagged changes on the withdrawal side. "There are a lot of changes which have happened on the exit side... what was allowed to take out money has been changed quite drastically," he said.

On distribution, Shukla said banks remain the industry's biggest last-mile channel for products such as Atal Pension Yojana (APY) and NPS. "So, banks are very big, big support... banks are the largest distributor of financial products in India today," he said.

He added that branches reduce selling costs because "bank branches sell multiple products... the cost gets divided."

A larger hurdle, he added, is low retirement awareness. "Today pension or pension requirement... is not taken too seriously by people... customers don't realize that pension is important," he said, urging early action: "Retirement is something which is inevitable... one has to prepare for it."

He said reforms are aimed at making NPS more mainstream in the private sector. "If you look at non-government sector, we are very, very thinly... not many people have NPS," he said, adding the goal is to make it "a default retirement product".

Shukla pushed for more flexibility versus EPF, especially for long-term investors. "Employee should be given a choice whether he wants to go with EPF or NPS... in NPS, the equity portion is quite high," he said.

On inflation protection, he said: "In our MSF framework, it is allowed we can go up to 100% equity. If we have to beat inflation in the long term, equity is the place that one has to be." He added: "And now the regulators also allowed investment in silver and gold... commodities which have appreciated sharply in the last couple of years."

Shukla said digital processes are central to scaling. "We believe in completely paper-free interaction," he said, adding onboarding can be done "in perhaps 2-3 clicks in 2 minutes" using Aadhaar and CKYC.

He said expanding coverage among the self-employed and gig workers is a major opportunity, citing industry outreach. He also linked growth to distributor incentives, saying the regulator is working on commissions so banks "earn decent amount of money".

On the market size, Shukla said India's pension industry is at about Rs 15 lakh crore in AUM and expects Rs 30 lakh crore by 2030. Axis Pension, he said, is "close to 15,000 crores of AUM" and aims to cross Rs 50,000 crore by FY27-28, after ending last year at around Rs 8,800 crore.