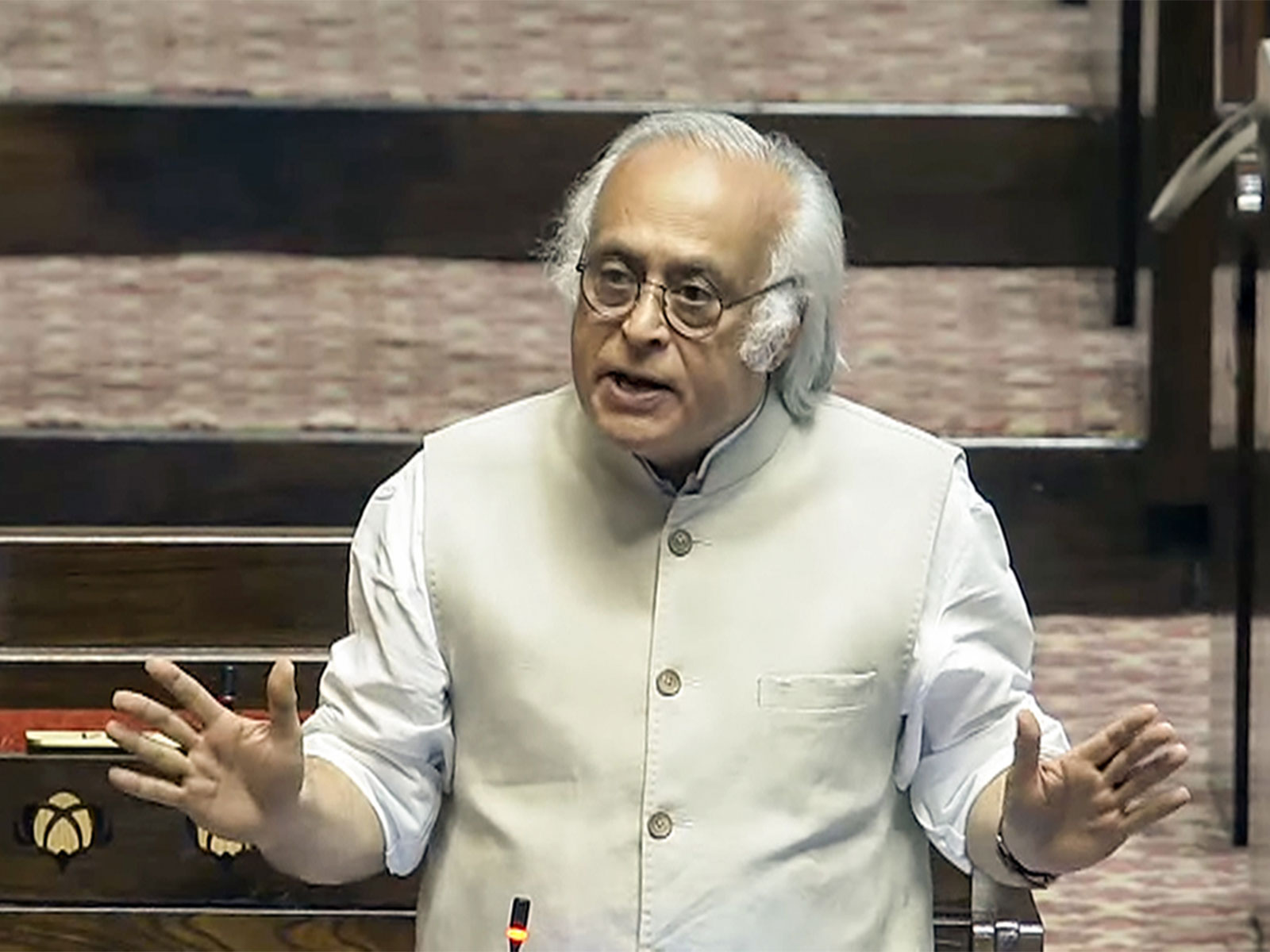

"RAM is focus area for our bank," says PNB ED M Paramasivam

Oct 19, 2025

New Delhi [India], October 19 : M Paramasivam, Executive Director of Punjab National Bank (PNB), stated on Sunday that the bank is focusing on strengthening its core segments -- retail, agriculture, and MSME loans and deposits -- as part of its growth strategy.

In banking, RAM is a common acronym for the Retail, Agriculture, and MSME loan and deposit segments. Banks focus on this sector because it represents a significant portion of their business and is often a key driver for growth.

Speaking to ANI after the announcements of financial results, Paramasivam said, "This quarter we have focused more on retail, agri and MSME. In fact, corporate growth has little subdued at almost 7.9 per cent, and if you touch the retail loans, vehicle loans have crossed more than 31 per cent and housing more than 13 per cent. MSME has grown with a growth rate of 18.6 per cent, and agriculture has also grown in that range. So overall RAM is a focus area for our bank."

Punjab National Bank (PNB) reported strong financial performance for the second quarter (Q2) of FY 2026, with net profit rising 14 per cent YoY to Rs 4,904 crore, compared to Rs 4,303 crore in Q2 FY'25.

Operating profit for the quarter grew 5.5 per cent YoY to Rs 7,227 crore, and 6.5 per cent YoY to Rs 14,308 crore for the first half of FY'26. Return on Assets (RoA) improved to 1.05 per cent from 1.02 per cent, while Net Interest Income (NII) for the first half (H1) of FY'26 increased slightly by 0.26 per cent to Rs 21,047 crore. The Net Interest Margin (NIM) stood at 2.65 per cent for H1 FY'26 and 2.60 per cent for the quarter.

On the asset quality front, GNPA improved by 103 bps to 3.45 per cent, and NNPA by 10 bps to 0.36 per cent YoY. The Provision Coverage Ratio (including TWO) also improved to 96.91 per cent.

The bank's global business grew 10.6 per cent YoY to Rs 27.87 lakh crore, with deposits rising 10.9 per cent to Rs 16.17 lakh crore and advances up 10.1 per cent to Rs 11.70 lakh crore. RAM (Retail, Agri, MSME) advances saw a healthy 12.7 per cent growth, reaching Rs 6.35 lakh crore. The Credit-Deposit Ratio improved to 72.33 per cent, while Capital Adequacy Ratio (CRAR) rose by 83 bps to 17.19 per cent, reflecting stronger capital positioning.

Looking ahead, Paramasivam said, "We have given a guidance of 11-12 per cent growth... though slightly lower this quarter, a lot of sanctioned loans are yet to be disbursed--around Rs 1.40 lakh crore."

Highlighting digital initiatives, Paramasivam said, "More than 100 digital products have been introduced. Personal loan scheme (PAPL) is highly successful... even tractor loans and renewals are being digitised."

On the broader economic impact, he concluded, "GST reforms are a very positive move... disposable income is higher, investment is going up, and it helps the economy as a whole."