Rapid Money Launches to Transform Short-Term Credit Access for Underserved Borrowers in India

Dec 19, 2025

VMPL

New Delhi [India], December 19: Rapid Money, a new Loan Service Provider (LSP) platform from the team behind SwitchMyLoan, has officially launched with a bold mission to offer fast, transparent, and easy-access short-term personal loans tailored for India's underserved borrowers. Built on deep borrower insights and frontline experience, Rapid Money aims to bridge critical credit gaps through a seamless digital journey that prioritises speed, simplicity, and fairness while actively facilitating financial inclusion across segments that have historically remained outside formal credit systems.

The Indian personal loan and digital lending landscape has seen rapid evolution, particularly in the small-ticket credit segment. FinTech lenders now dominate small personal loan volumes, accounting for roughly three-quarters of all personal loans disbursed by volume and playing a central role in expanding formal credit access across the country. Digital lenders disbursed over 6.4 crore loans in the first half of FY25-26, representing around 80% of personal loan volumes, with average ticket sizes concentrated in the small-value bracket reflecting heightened demand among younger, first-time, and underserved borrowers. This shift underscores the growing role of technology-led platforms in facilitating financial inclusion at scale.

Despite this growth, millions of Indians still face excessive documentation requirements, long processing times, limited credit awareness, and rigid eligibility criteria that can delay or prevent access to necessary credit. Rapid Money directly addresses these challenges with short-term personal loans of up to ₹50,000 for both salaried and self-employed individuals. Using a bureau-based, simulation-driven approval engine, the platform enables onboarding and personalised loan offers within minutes significantly reducing friction while also encouraging responsible borrowing through transparent terms and clear repayment structures, thereby enhancing financial literacy among users.

To maximise accessibility across devices, connectivity conditions, and borrower preferences, Rapid Money offers both Web and Android app journeys, enabling users to apply and complete their entire loan process seamlessly, whether on a smartphone or browser. This dual-platform approach ensures broad reach from urban customers to those in semi-urban and rural India.

As a regulated LSP, Rapid Money is powered by multiple back-end NBFC partners, ensuring that access to capital is not only swift but also safe, compliant, and scalable. With expertise drawn from years of operating as one of India's trusted digital loan aggregators, the SwitchMyLoan team has infused the platform with deep borrower understanding spanning behavioural patterns, underserved profiles, and the urgency behind short-term financial needs -- enabling more inclusive and informed credit access.

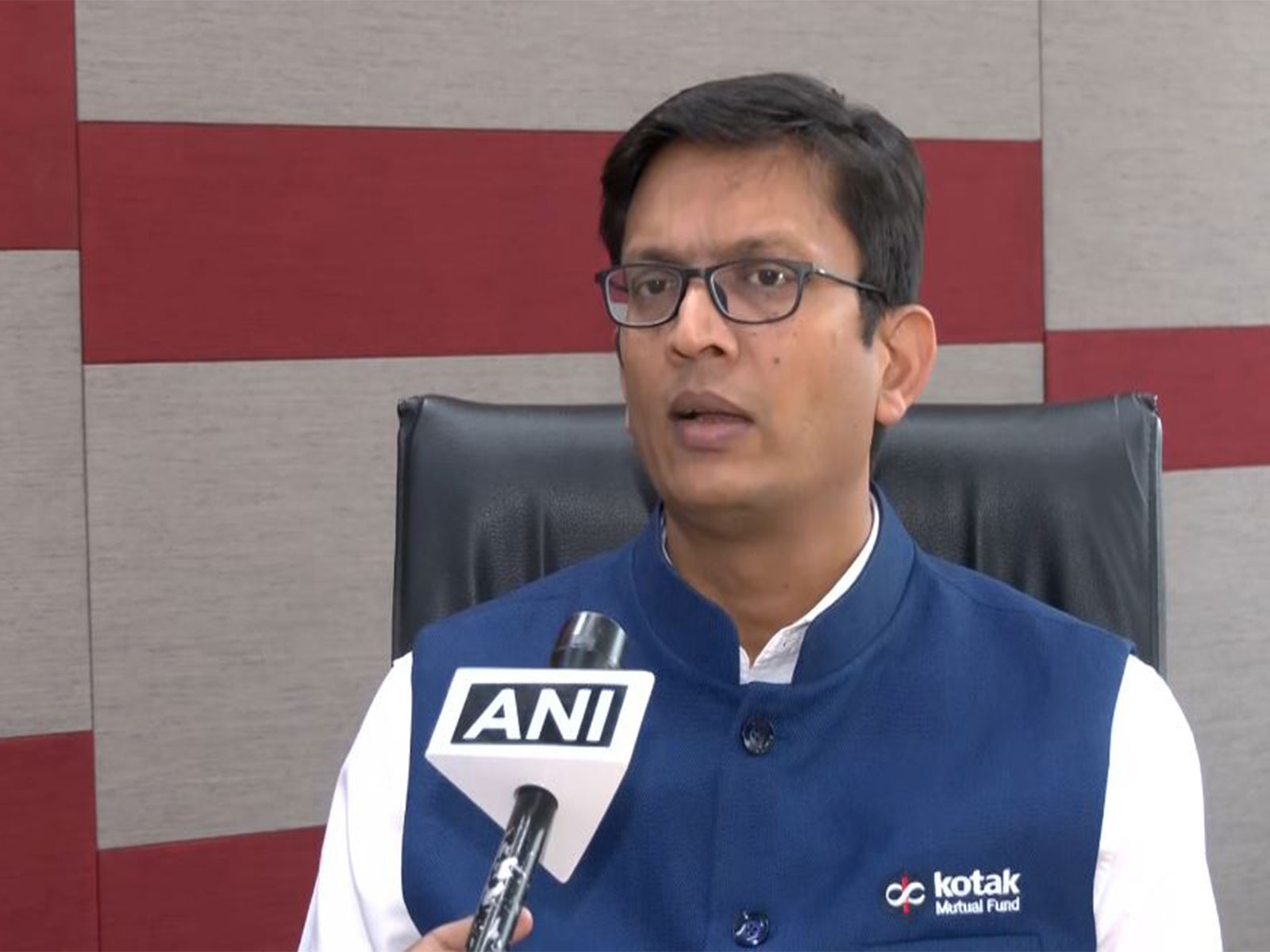

Chintan Panchmatya, Founder, SwitchMyLoan, said: "For years, we've seen borrowers struggle not because of intent, but because the system wasn't designed for their realities. Rapid Money is our step towards fixing that. By combining our borrower insights with a compliant, NBFC-backed LSP model, we're facilitating financial inclusion while making short-term credit fast, safe, and truly accessible -- exactly the way it should be for today's India."

Ashwanii Manaktala, Head of LSP Business, Rapid Money, added: "Rapid Money is built on a very clear promise to give borrowers credit that is simple, transparent, and truly within reach. With SwitchMyLoan's rich ecosystem experience and our strong NBFC partnerships, we are creating a model that can scale responsibly while enhancing financial literacy and staying deeply customer-centric. Our focus is to not only solve today's credit gaps but also set a long-term vision for how short-term lending in India should evolve."

With this launch, Rapid Money aims to become India's most reliable partner for quick, safe, compliant, and scalable short-term credit ensuring borrowers get fast access to capital in a responsible, transparent, and future-ready way.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)