RBI to issue draft guidelines for protecting customers from mis-selling, among others

Feb 06, 2026

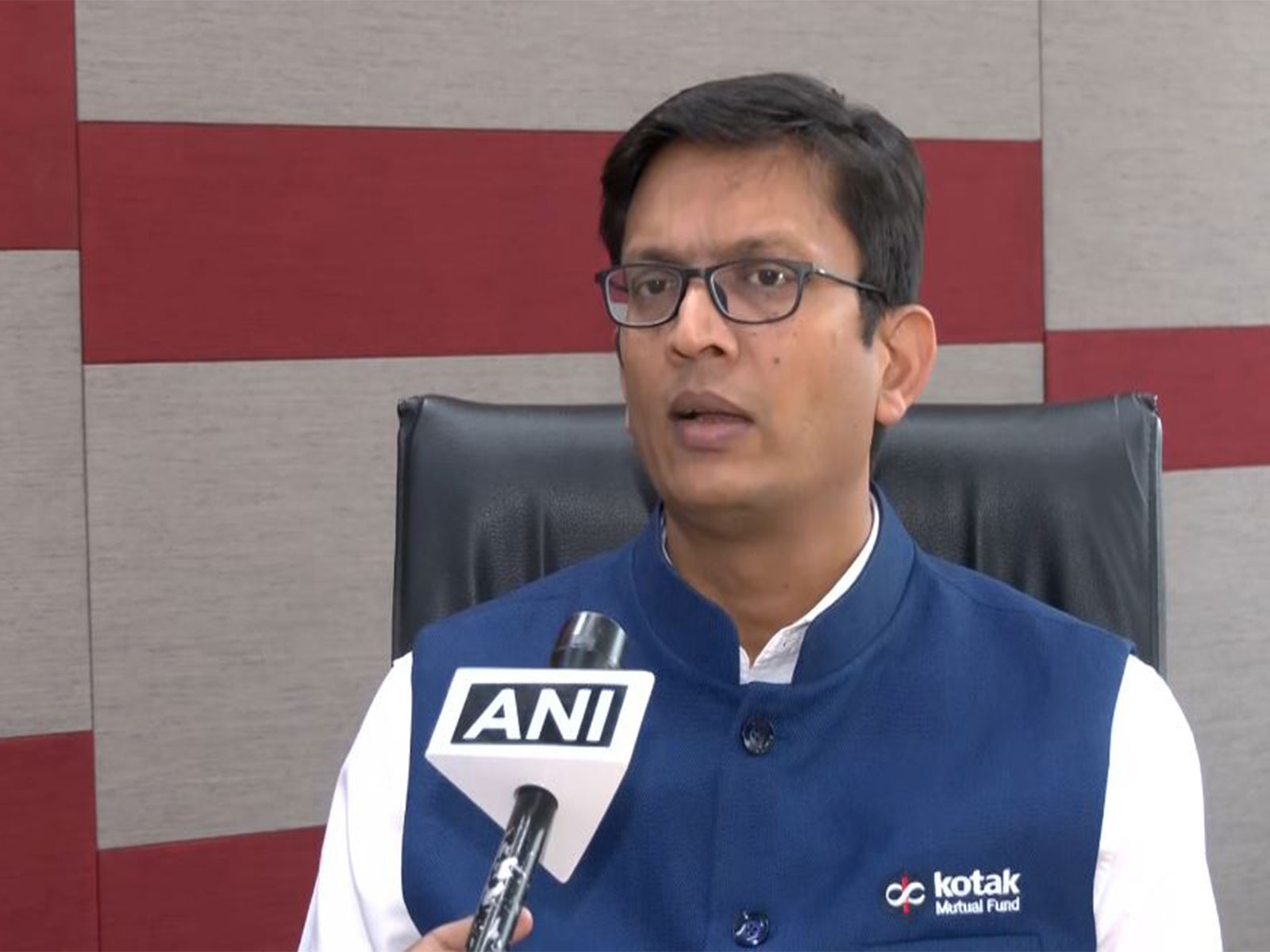

Mumbai (Maharashtra) [India], February 6 : Reserve Bank of India Governor Sanjay Malhotra on Friday proposed to issue three draft guidelines for customer protection: one, relating to mis-selling; two, regarding recovery of loans and engagement of recovery agents; and three, on limiting liability of customers in unauthorised electronic banking transactions.

Reading the monetary policy statement, the RBI Governor announced a set of measures which are aimed at enhancing customer protection, advancing financial inclusion, enhance flow of credit, strengthening urban cooperative banks (UCBs), promoting ease of doing business for NBFCs, and deepening financial markets.

It has also been proposed to introduce a framework to compensate customers up to an amount of Rs 25000/- for loss incurred in small-value fraudulent transactions.

He announced that RBI will also publish a discussion paper on possible measures to enhance the safety of digital payments.

"Such measures may include lagged credits and additional authentication for specific class of users like senior citizens," the Governor said.

He announced that the limit of Rs 10 lakh for collateral-free loans to MSMEs is proposed to be increased to Rs 20 lakh.

In the financial inclusion space, the governor said RBI has comprehensively reviewed the Lead Bank Scheme, Kisan Credit Card Scheme and the Business Correspondent Model.

"We shall issue draft revised guidelines with respect to them. A unified reporting portal will also be launched by us for better management of LBS data," he said.

To further promote financing to real estate sector, it is proposed to allow banks to lend to REITs with certain prudential safeguards.

To strengthen urban cooperative banks, he announced four measures. "The first two pertain to raising the financial limits on unsecured loans and loans to nominal members by UCBs. We also propose to remove the tenor and moratorium-related requirements on housing loans given by Tier III and Tier IV UCBs. To strengthen the managerial and technical capacity of the UCBs, we shall launch Mission-SAKSHAM (Sahakari Bank Kshamta Nirman). The mission intends to train over 1.4 lakh participants from UCBs."

On NBFCs, he said those having no public funds and customer interface, with asset size not exceeding Rs 1000 crore, are proposed to be exempted from the requirement of registration. Moreover, it is proposed to dispense with the requirement for certain NBFCs to obtain prior approval to open more than 1000 branches.