Sathlokhar Synergys E&C Global Limited Delivers Stellar H1 FY26 With 75.6% Revenue Jump & 70.1% PAT Rise

Nov 11, 2025

PNN

Chennai (Tamil Nadu) [India], November 11: Sathlokhar Synergys E&C Global Limited (NSE - SSEGL), one of the leading EPC players, providing end-to-end turnkey execution across design, civil works, PEB structures, MEP systems, solar installations, and interior fit-outs, has announced its Unaudited Financial Results for H1 FY26.

Key Financial Highlights

* Total Income of ₹ 250.21 Cr, YoY growth of 75.58%

* EBITDA of ₹ 38.99 Cr, YoY growth of 70.13%

* EBITDA Margin of 15.58%

* PAT of ₹ 27.98 Cr, YoY growth of 70.10%

* PAT Margin of 11.18%

* EPS of ₹ 11.59, YoY growth of 20.73%

Order Book Snapshot

* Current order book: ₹ 1367.71 Cr

* Pipeline Bids: ₹ 13,637 Cr

* Ongoing Projects: 34

* Execution Visibility: 05 to 9 months with a strong H2 ramp-up expected in the second half of the year.

Operational Highlights H1 FY26

Commenting on the financial performance, Mr G. Thiyagu, Managing Director of Sathlokhar Synergys E&C Global Limited, said, "Our first half performance marks a transformational year for the company, underscoring the sharp growth trajectory achieved since listing. Turnover is rising by nearly 75% year-over-year, reflecting the strength of our execution capabilities, financial discipline, and growing client trust across our core EPC verticals.

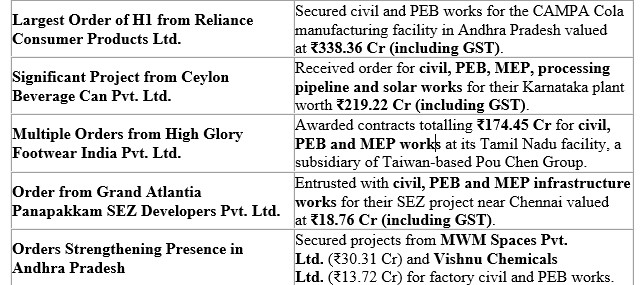

During H1 FY26, we achieved a record order inflow of approximately ₹830 Cr, a milestone achievement considering our full-year revenue of around ₹400 Cr in FY25. Major orders such as ₹338.36 Cr from Reliance Consumer Products Ltd. and ₹219.22 Cr from Ceylon Beverage Can Pvt. Ltd. reaffirm our growing credibility among top-tier clients. With an order book of ₹1367.71 Cr and a bid pipeline exceeding ₹13,637 Cr, we are positioned for an intense execution phase in H2. The recent ₹114 Cr fundraise provides additional momentum to support scale-up and operational growth.

Looking ahead, our strategic priorities centre on strengthening repeat business, expanding geographically, and broadening sectoral diversification. With a strong project pipeline, solid execution visibility, and strengthened financial base, we remain confident of sustaining growth and delivering long-term value for all stakeholders."

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PNN. ANI will not be responsible in any way for the content of the same.)