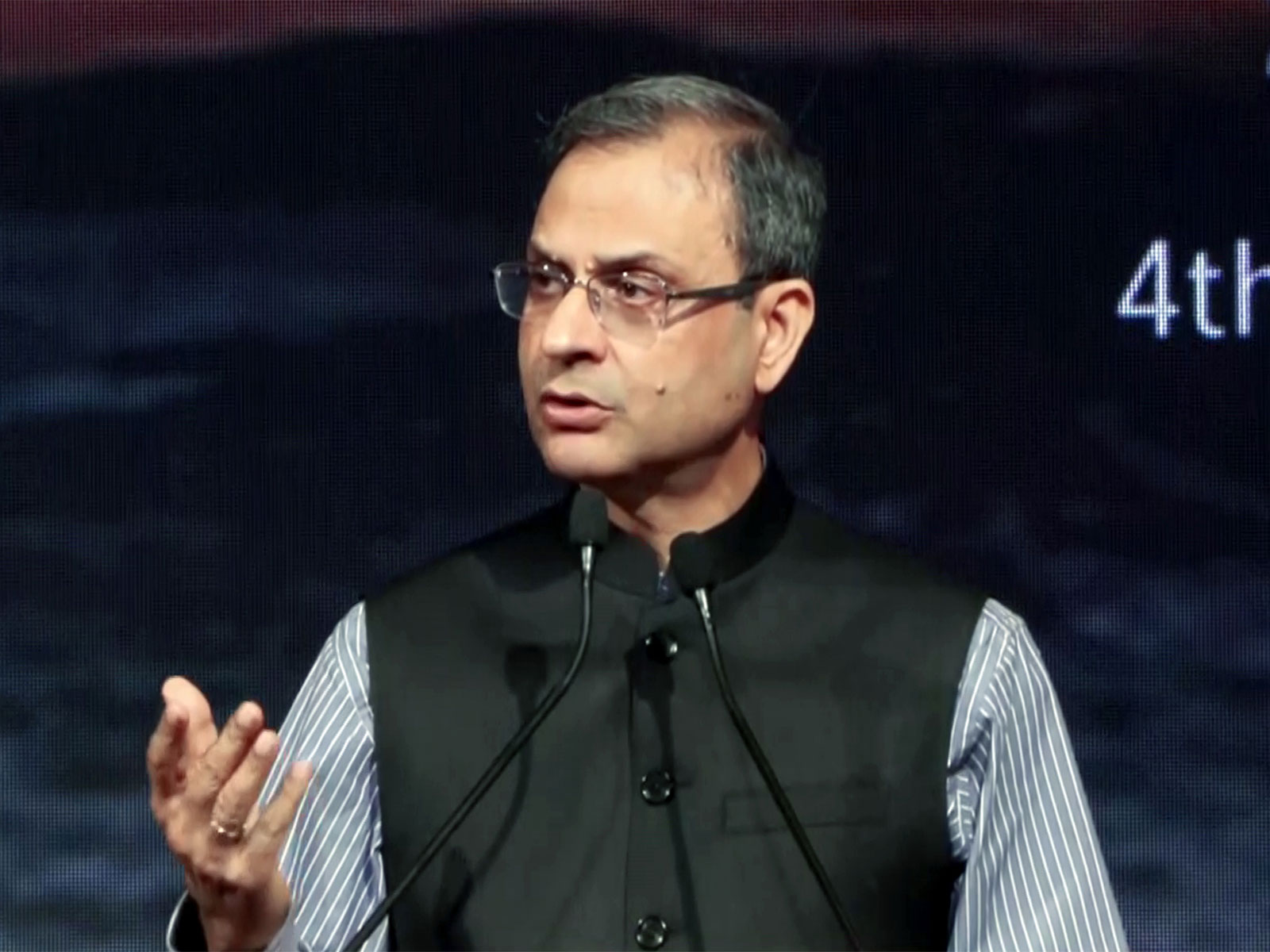

Strong coordination between monetary and fiscal policies helped India manage inflation amid US tariffs: RBI Governor

Oct 17, 2025

New Delhi [India], October 17 : Reserve Bank of India (RBI) Governor Sanjay Malhotra said that fiscal consolidation and strong coordination between monetary and fiscal policies have played a key role in helping India manage inflation while supporting economic growth during challenging times marked by tariffs and global uncertainty.

The RBI Governor made these remarks during his interaction with Krishna Srinivasan, Director of the Asia and Pacific Department at the International Monetary Fund (IMF), as a part of the Annual Meetings of the IMF.

Responding to a question on how challenging it has been for emerging markets like India to manage inflation amid rising tariffs and commodity price volatility, Malhotra said that a coordinated approach between the central bank and fiscal authorities has been crucial.

"A coordinated effort with the fiscal authorities, identifying what the pressure points are, both on the demand side and supply side, and this coordinated action really helped us," he stated.

He further said that fiscal discipline by both the central and state governments has supported India's macroeconomic stability.

"What has also helped is the fiscal latitude which the central government and the state governments have observed. Fiscal deficit now is at a very manageable level, projected now, budgeted to be down to 4.4 per cent of GDP for the central government, and the total debt of the governments, both state and central, together is amongst the lowest, amongst the large debt economies. I think it's only Germany which has lower public debt levels," he said.

On managing exchange rate volatility, Malhotra said that while emerging market currencies have been quite volatile against the US dollar, India's approach has been to ensure orderly movement of the rupee rather than target any specific level.

"You see, from the peak, dollar has depreciated by about 10 per cent this year, and now it is moving range-bound. The Indian rupee has, on the other hand, it's not appreciated as much vis-a-vis the dollar, whereas most of the other currencies this year, post-liberation, they have appreciated," Malhotra noted.

He attributed this to higher tariffs and some capital outflows, adding that the performance of the Indian rupee and equities has been strong over time.

"Prior to Liberation Day, say, since 2024, the Indian equities and the Indian rupee actually outperformed others. So, in a way, in some sense, it's also a correction," he said.

He emphasized that India's foreign exchange markets are deep and robust, and the central bank's focus remains on maintaining stability.

"Our effort really is to ensure that there is an orderly movement of the rupee and any undue volatility is curbed," Malhotra said.